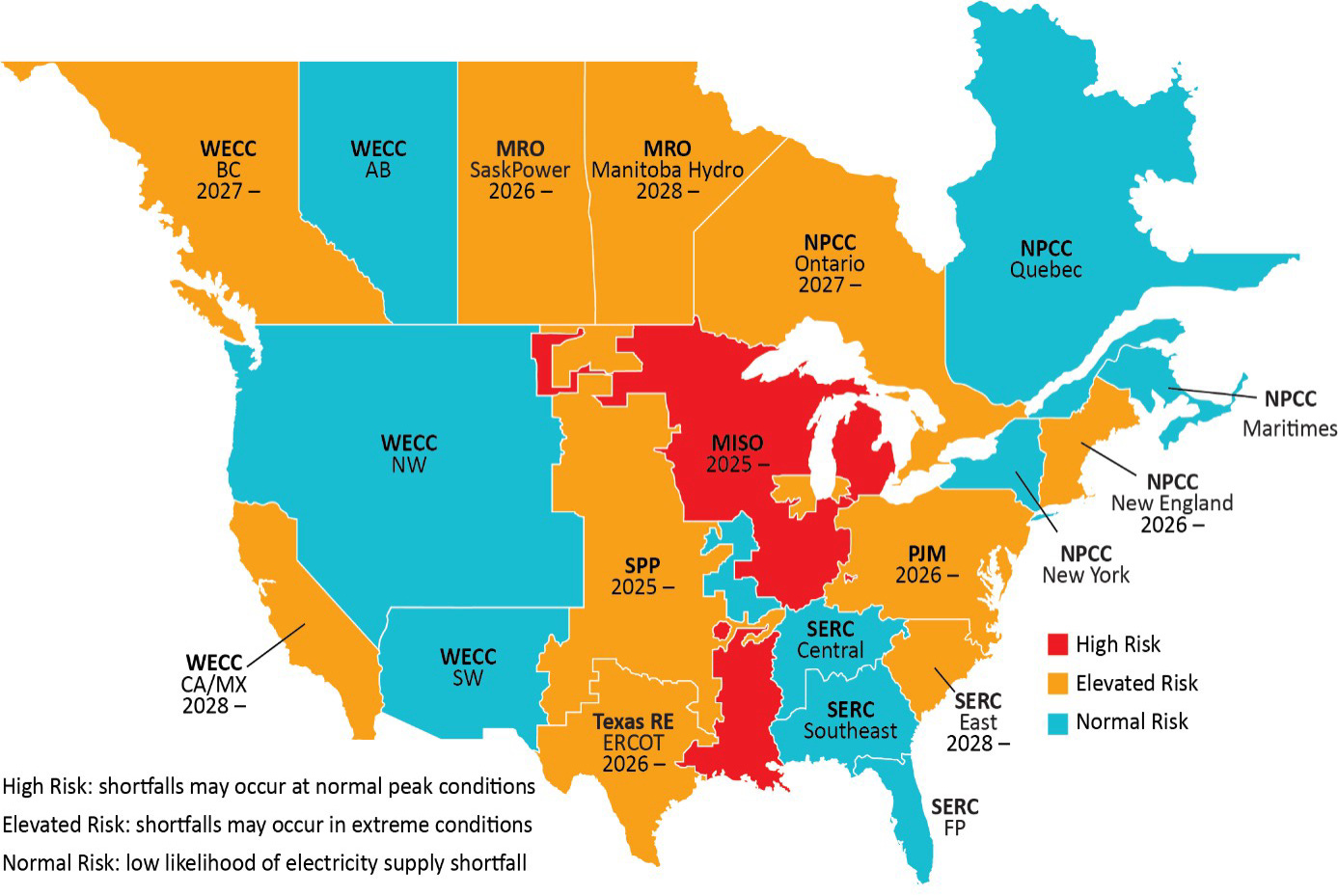

NERC Report Tells Us Most of North America Is at Elevated or High Risk When It Comes to Energy Security

The North American Electric Reliability Corporation (NERC) is a non-profit international regulatory authority designated by our Federal Energy Regulatory Commission (FERC) with the responsibility to assure the reliability of the Bulk‐Power System (BPS) in North America. It regulatory assesses the adequacy of the system in North America and reports its findings back to FERC. The latest overall report was released three weeks ago and it speaks plainly, in a way that is far too uncommon today..

Here are some key excerpts from the report, which are largely self-explanatory in ringing energy security alarm bells (emphasis added in some instances):

NERC finds that most of the North American BPS faces mounting resource adequacy challenges over the next 10 years as surging demand growth continues and thermal generators announce plans for retirement. New solar PV, battery, and hybrid resources continue to flood interconnection queues, but completion rates are lagging behind the need for new generation. Furthermore, the performance of these replacement resources is more variable and weather- dependent than the generators they are replacing. As a result, less overall capacity (dispatchable capacity in particular) is being added to the system than what was projected and needed to meet future demand. The trends point to critical reliability challenges facing the industry: satisfying escalating energy growth, managing generator retirements, and accelerating resource and transmission development…

As older fossil-fired generators retire and are replaced by more solar PV and wind resources, the resource mix is becoming increasingly variable and weather-dependent. Solar PV, wind, and other variable energy resources (VER) contribute some fraction of their nameplate capacity output to serving demand based on the energy-producing inputs (e.g., solar irradiance, wind speed). The new resources also have different physical and operating characteristics from the generators that they are replacing, affecting the essential reliability services (ERS) that the resource mix provides. As generators are deactivated and replaced by new types of resources, ERS must still be maintained for the grid to operate reliably.

Natural-gas-fired generators are a vital BPS resource. They provide ERS by ramping up and down to balance a more variable resource mix and are a dispatchable electricity supply for winter and times when wind and solar resources are less capable of serving demand. Natural gas pipeline capacity additions over the past seven years are trending downward, and some areas could experience insufficient pipeline capacity for electric generation during peak periods…

Electricity peak demand and energy growth forecasts over the 10-year assessment period continue to climb; demand growth is now higher than at any point in the past two decades. Increasing amounts of large commercial and industrial loads are connecting rapidly to the BPS. The size and speed with which data centers (including crypto and AI) can be constructed and connect to the grid presents unique challenges for demand forecasting and planning for system behavior. Additionally, the continued adoption of electric vehicles and heat pumps is a substantial driver for demand around North America. The aggregated BPS-wide projections for both winter and summer have increased massively over the 10-year period…

New transmission projects are being driven to support new generation and enhance reliability. Transmission development continues to be affected by siting and permitting challenges. Of the 1,160 projects that are under construction or in planning for the next 10 years, 68 projects totaling 1,230 miles of new transmission are delayed by siting and permitting issues, according to data collected for the LTRA. Questions of cost allocation and recovery can also challenge transmission development when the benefits apply to more than one area, as often occurs with projects that enhance interregional transfer capability…

Most areas are projected to have electricity supply resources to meet demand forecasts associated with normal weather. However, the following areas … do not meet resource adequacy criteria at some point during the next five years, indicating that the supply of electricity for these areas is likely to be insufficient and more firm resources are needed.

MISO [Midcontinent Independent System Operator]

Additional coal-fired generator retirements and slower-than-anticipated resource additions since the 2023 LTRA have caused a sharp decline in anticipated resources beginning next summer (2025). In addition, MISO’s peak demand forecast has risen in 2026… [N]ew generation is insufficient to make up for generator retirements and load growth... Delays to generator construction in MISO result in a 2.7 GW shortfall by 2029…

NPCC-New England

New England is forecasting unprecedented demand growth driven by electrification of heating and transportation. Wind, solar, and batteries make up the projected resource additions, along with growth in distributed energy resources…New England has among the strongest winter demand forecast growth rates of any assessment area, rising over 7 GW in the 10-year period, or 35% from its current peak demand forecast… Higher-demand forecast and replacement of dispatchable resources with more VERs contribute to this trend…

Texas RE-ERCOT

ERCOT is forecasting explosive demand growth, driven by data center projects, Bitcoin operations, development in oil- and natural-gas-producing areas, and industrial facilities. Over 20 GW of newly contracted large loads, in addition to other organic load growth, is projected to be added to ERCOT by 2028. Substantial amounts of solar PV and battery resources are being added to help meet rising demand, but there are significant reliability challenges to address during this period of rapid growth. Resource adequacy risks are mounting as fewer dispatchable resources comprise the resource mix. One of the strategies to address this risk is state implementation of a dispatchable resource generation loan program called the Texas Energy Fund. Furthermore, the forecasted growth in loads and resources poses significant challenges for transmission system planners…

PJM [Pennsylvania Jersey Maryland Interconnection]

Overall, new generation is coming on-line slower than anticipated. Generator retirements are outpacing the new generation replacing them. As a result, PJM could face future resource adequacy challenges, impacting system reliability and PJM’s ability to serve load. PJM could be at risk of facing resource adequacy challenges if these trends continue. PJM has applied an 11% reduction to the nameplate value of Tier 1 resources to reflect the historical rate of slower-than-anticipated addition of new generation…

PJM’s existing installed capacity reflects a fuel mix consisting of approximately 48% natural gas, 22% coal, and 18% nuclear. Hydro, wind, solar, oil, and waste fuels constitute the remaining 12%. A diverse generation portfolio reduces the system risk associated with fuel availability and reduces dispatch price volatility. Totaling nearly 125,000 MW of CIRs, renewable and hybrid fuels are changing the landscape of PJM’s interconnection process. Solar energy makes up 40% of the new service requests in PJM’s generation interconnection queue. State policies encouraging renewable generation are contributing to the rise in solar generation interconnection requests.

PJM’s review of recent policies indicates over 32 GWs of potential deactivations through 2034. The pace of retirements is being driven in large part by state laws and federal environmental initiatives that create a clear near-term, date-certain requirement for generators to comply or retire…

Conversely, there are multiple mandates with RPS that account for the majority of over 150 GWs in submitted projects. Growing levels of intermittent and limited duration resources, such as wind, solar, and battery storage, do not replace conventional large-scale generation installations megawatt-for-megawatt but rather require multiple megawatts to replace one megawatt of dispatchable generation due to their limited availability in certain hours of the day and seasons of the year.

Many megawatts from a range of generation technologies, available at different times, are required to replace a megawatt of thermal generating capacity. Looking out over the next 8 to 10 years of the energy resource transition, maintaining an adequate level of generation resources with operational and physical characteristics that support reliability will be crucial for PJM’s ability to serve electrical demand reliably.

There is much more to the report, but the above excerpts demonstrate just how badly Federal and state subsidies, mandates and Renewable Portfolio Standards (RPS) are undermining our energy security. Government, although a necessary evil, endangers everything it touches, of course, as California fires are currently demonstrating, but that is especially the case with energy. Our elected officials have inserted themselves into energy planning for reasons of virtue signaling and pushing the Big Green Grift. We see the rotten fruits of this practice in the latest NERC assessment.

That assessment, though, only addresses the physical aspects of energy security, and not the financial. If those were included, we would see the most severe negative impacts in places such as California and Connecticut, where electricity prices are well over double those of more rational states, but that's a story for next time. What we know for now, is that most of North America is at the point of elevated or high risk when it comes to physical energy security thanks to stupid green tricks that must be ended.

#StupidGreenTricks #NERC #FERC #BigGreenGrift #EnergySecurity #EnergyReliability

Many people need to “see the light” before it is to late. Thanks for another great article.

Maybe we should send our electeds to Germany for field trip to the energy graveyard. Or show them a few of germanys energy bills from the last two months. Violent stupidity paid for by our taxes.