Guest Post by Jim Willis at Marcellus Drilling News.

Flex LNG, headquartered in Hamilton, Bermuda, owns 13 LNG cargo carriers. It published its latest presentation (PowerPoint slide deck) recently to coincide with CFO Knut Traaholt’s upcoming meetings with investors in the U.S. and Canada as part of a “non-deal roadshow.”

Flex’s fleet is small compared with others (not even in the top 10 list). However, the slide deck includes some great slides that give us an inside look at the coming growth in American LNG exports and details about which countries are likely to buy increased supplies of LNG.

The first slides in the file focus on Flex LNG’s fleet with various metrics. However, starting with slide #11, the slides focus on the larger worldwide LNG markets.

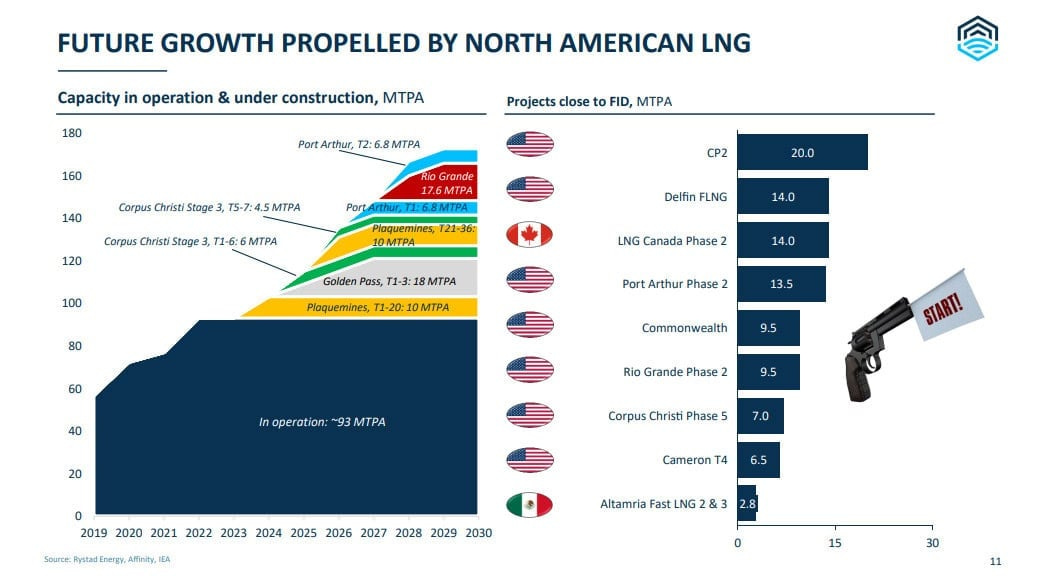

Slide #11 is a great slide. The left side shows a graphic depicting when various LNG facilities currently under construction have or will be online and how their output adds up to close to 180 MTPA of U.S. LNG export capacity. The right side shows projects close to making a final investment decision (FID).

Slide #12 shows the three “waves” of LNG export capacity added by country. As you can see, the U.S. came out of nowhere to become the world’s #1 LNG exporter, a position it will hold in the foreseeable future.

We really like the next slide (#13), which shows (on the left) the top LNG exporting countries and (on the right) the top LNG importing countries.

Europe continues to be a major destination for LNG. While most of Europe’s imports come from the U.S., 15-20% come from Russia, which will continue for the foreseeable future.

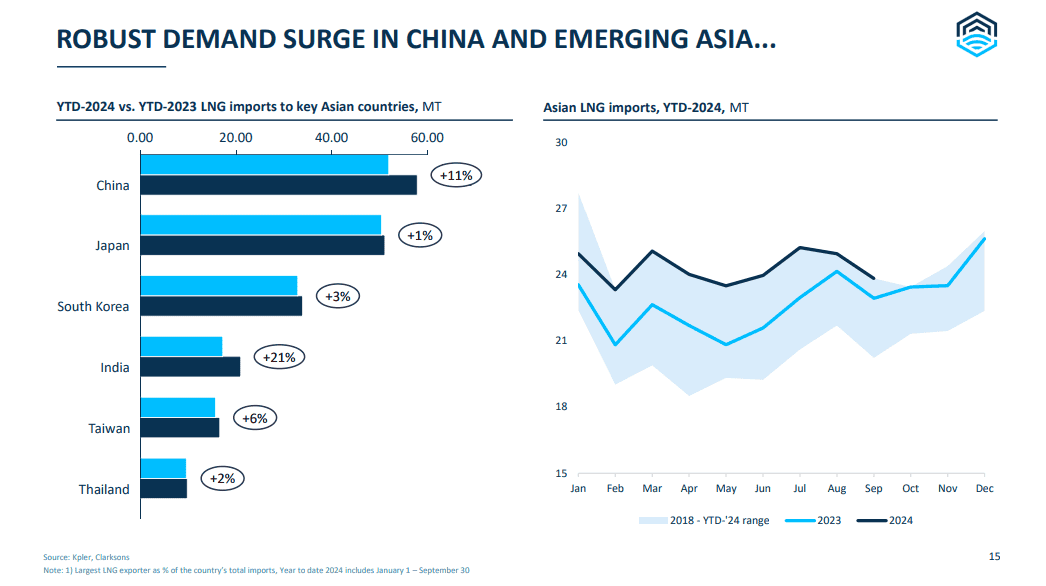

The next slide (#15) compares LNG imports to Asian countries between last year and this year. The biggest percentage increase is for India.

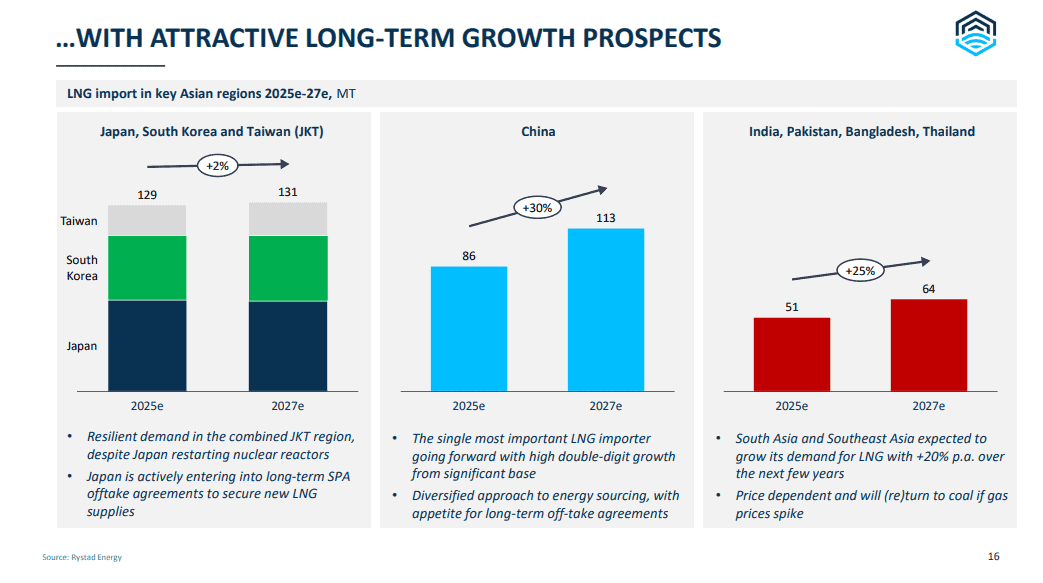

Finally, the last slide (#16) shows projected import growth from 2025 to 2027. China takes the cake.

In researching LNG for this post, we came across a post from last December that provides some good context. It’s called “Top 10 LNG Tanker Companies in the World: An Overview.”

The top 10 LNG tanker companies are:

Nakilat

Mitsui Osk Lines(MOL)

NYK

Maran Gas

Seaspeak

MISC Berhad

BW Group

GasLog

Shell

Dynagas

The post’s opening says there was a worldwide LNG tanker fleet of 639 ships as of last December. There were (at that time) another 288 LNG carriers on order. Next year alone (2025), there are supposed to be 101 new LNG carriers delivered and placed into service.

In an era of surging global demand for liquefied natural gas (LNG), the LNG carrier industry finds itself in a pivotal position, facilitating the vital movement of this chilled fuel from production hubs to consumption canters.

The world’s reliance on LNG has never been more pronounced, underlining the critical role played by the largest LNG shipping companies in this high-stakes energy trade. Take, for instance, the recent Gas supply crunch in European markets due to the ongoing Russia-Ukraine market, and the heightened importance of LNG shipping to the energy security of Europe currently.

Through meticulous analysis encompassing fleet statistics, order book data, and ongoing operations, we have delved into the intricate landscape of the global LNG carrier industry. Our comprehensive data collection spans over 700 LNG tankers and floating storage regasification units (FSRUs), equipping us to spotlight the top 10 LNG shipping companies. Our investigation sheds light on critical details, from ship capacities to ownership structures and operational footprints.

LNG Market Insight: The global LNG shipping industry is on the cusp of a significant expansion, with analysts forecasting a robust 7.5% growth in the LNG vessel fleet this year. This surge in fleet size is in response to the escalating demand for liquefied natural gas and the continuous expansion of production capacities worldwide.

Currently, the LNG fleet comprises approximately 639 vessels, excluding floating storage regasification units, dedicated storage ships, and bunkering vessels. These vessels collectively offer an impressive 100 million cubic meters of capacity, equivalent to a substantial 54 million deadweight tonnes, according to assessments by Energy Aspects.

Orderbook: The LNG carrier order book has witnessed a substantial surge, mirroring the heightened global demand for liquefied natural gas and its transportation via maritime routes. The combined count of new vessels on order, slated for delivery from 2023 onward, has surged to surpass 288 LNG tankers, reaching its zenith in 2025 when it encompasses 101 LNG carriers alongside 1 FSU.

Estimating the collective investments in the LNG fleet yields figures ranging from $72 billion to $92 billion, taking into account the average reported cost of constructing an LNG tanker, which hovers between $250 million to $320 million per vessel.

#LNG #FlexLNG #ThirdWave #Europe #USA #LNGcarriers #MarcellusDrillingNews #Exports #Imports

Wait! There must be some mistake, as Canada's prime minister, Justin Trudeau, said that the business case for LNG is weak. :)

We’ll start to see all the AI and data centers rush to build out gas power plants to that will be fueled by all this LNG. Right now they are in the stage of recommissioning old nuclear but those will be bought up quickly. Then when they realize new nuclear is 7-10 years out at a minimum, combined cycle gas will come through again.