The Giant Solar Balloon Pops As China Moves to Destroy All Competition And Grifters Demand Bigger Subsidies

The solar boom has busted: In the last six months Europe’s solar manufacturing has collapsed by half…

Europe’s solar manufacturers are in a crisis.

Forty year old German solar panel producers are closing factories they only opened three years ago.

The world now has the capacity to make 1,600 GW of solar panels annually, but demand has unexpectedly flat-lined — staying at barely 500GW. In a world awash with solar panels that no one needs, prices have fallen dramatically, but that hasn’t solved the glut which is so bad, people are using solar panels for fencing in Europe.

The CCP has bet big that the exponential growth curve in solar customers was going to keep being exponential. Instead, demand flattened off suddenly. Currently, 80% of the world’s solar panels are pouring out of China.

With impeccable timing, just weeks ago the Australian Government threw a billion dollars at a program to help Australia become a solar panel superfactory just at the moment when China is practically giving them away.

Australia is hardly the only nation to jump on the solar bandwagon as its wheels are falling off. Just two months ago, the Biden-Harris bragged as follows:

President Biden’s Investing in America agenda has catalyzed an American clean energy manufacturing and deployment boom. Through the President’s Inflation Reduction Act, incentives for manufacturing and deployment of clean energy, including incentives for domestically-manufactured solar products, have driven a historic surge in solar installations and announcements of new U.S. solar module and component manufacturing.

Is there any doubt America and Australia will follow Europe over the cliff? And, a report from the European Solar Manufacturing Council tells us precisely what will be required to sustain a solar panel manufacturing industry. It’s titled “How to Address the Unsustainably Low PV Module Prices to Ensure A Renaissance of the PV Industry in Europe” and it speaks plainly, as these excerpts illustrate:

Chinese-made PV modules are currently piling in European warehouses, with an estimated 40 GWdc of capacity stored — equivalent to 2022's entire continent-wide installation volume — which are valued at approximately €7 billion. Domestically produced modules can´t match the imports, and from 2021 to 2022, Chinese solar modules imports grew 112% to around 87 GWdc, while installations PV Manufacturing in Europe: understanding the value chain for a successful industrial policy lagged in, resulting in a 47 GWdc gap in 2022 between shipped and installed modules…

Announcements for new production capacities in China show no pause and more companies are strong imbalance that already exists between market demand and production will lead to a prolonged situation of low prices, pushing for a consolidation of the industry in China and the absolute inability outside of China to develop any competitor. This situation is reinforced by the announcement of the Chinese government that it will support the manufacturing industry by increasing its local market, from 92 GW in 2022 to possibly 150 GW in 2023. This increase is anyway much lower than the new additions in manufacturing capacities and will lead to further price decreases…

The current challenges of the import of unsustainably low-priced modules from China poses a severe threat to European PV manufacturing capabilities, jeopardizing any aspirations of establishing a resilient PV manufacturing value chain in Europe. To address these challenges, the European Solar PV Industry Alliance is actively developing mid- and long-term proposals across various fronts, encompassing financing, supply chain, demand-side, and skills frameworks.

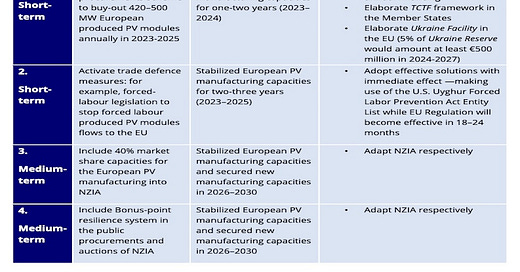

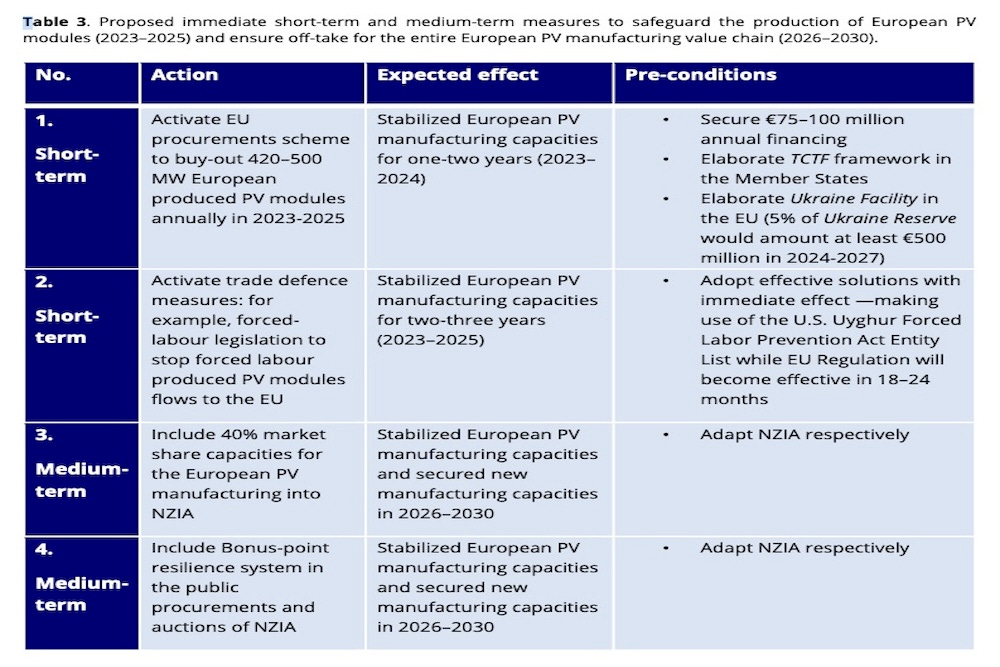

And, this table sums up what Europe’s solar manufacturers say they need to survive:

It doesn’t get much more clear; they want financing, guaranteed market share and more protection and subsidies. It’s an industry completely dependent on ratepayer and taxpayer support above and beyond what the market delivers. It cannot compete and, therefore, it should not exist and has no future.

#Solar #SolarPanels #Manufacturing #China #Europe

I'm one of the few homeowners for whom solar made sense. I had money to spend, a limited time to spend it (age) and an off-grid house that needed power. Every part of my system was made in China. Do we really want to be EVEN MORE dependent on China than we already are? Then keep touting solar power and giving tax breaks for installating dumped Chinese equipment priced below production costs to drive competitors out of the market. The market can't survive without subsidies? Maybe that should tell us something.

Insanity. It's "Reverse Robin Hood" where the economic elites are enriched by the "little people." Here's one example of a well-heeled elite who admitted circa 2014 he is on the gravy train at taxpayer expense. (Buffett's father was a four-term U.S. Representative from Nebraska.) Multi-billionaire Warren Buffett explained the rationale for solar and wind generation in 2014:

"For example, on wind energy, we get a tax credit if we build a lot of wind farms. That's the only reason to build them. They don't make sense without the tax credit."

"Big Wind's Bogus Subsidies - Giving tax credits to the wind energy industry is a waste of time and money."

By Nancy Pfotenhauer, Contributor | May 12, 2014, at 2:30 p.m US News & World Report

https://tinyurl.com/Buffett-Wind-Scam