The Commodity Rule: Get Big, Get Weird or Get Out

The rule of commodity prices is: they go up after they go down, and down after they go up, as producers adjust production in response to demand. This forces producers to get big, get weird or get out!

Guest post by Jim Willis of Marcellus Drilling News.

In a companion post, we brought you Bloomberg’s prediction of $4 natgas this summer based on the false premise of wild, scorching heat from man-made global warming. Whatever. This post contains predictions by analysts with J.P. Morgan for the price of natural gas for the rest of this year and into 2025. J.P. Morgan’s predictions are grounded in reality, not wild speculation like Bloomberg’s. J.P. Morgan predicts the Henry Hub price to average $2.88 per million British thermal units (MMBtu) in 2024 and $4.75 per MMBtu in 2025. They break it down quarter by quarter…

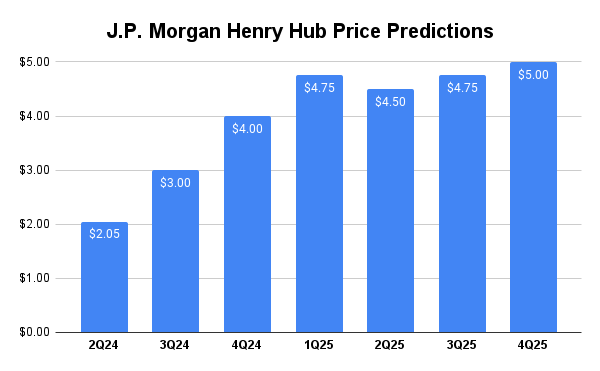

We’ve charted the data from the Rigzone article below in a handy chart showing J.P. Morgan’s Henry Hub price prediction by quarter:

J.P. Morgan has revealed its latest Brent, WTI, and Henry Hub gas price forecasts in a research note sent to Rigzone this week.

According to the note, J.P. Morgan anticipates the Brent crude price to average $84 per barrel in 2024 and $75 per barrel in 2025, and the WTI crude price to average $79 per barrel this year and $71 per barrel next year. The Henry Hub price is expected to average $2.88 per million British thermal units (MMBtu) in 2024 and $4.75 per MMBtu in 2025, the note revealed.

Broken down quarterly, the company anticipates in the research note that Brent crude will come in at $84 per barrel across the second and third quarters of this year, $85 per barrel in the fourth quarter, $82 per barrel in the first quarter of 2025, $77 per barrel in the second quarter, $73 per barrel in the third quarter, and $69 per barrel in the fourth quarter of 2025.

The WTI crude price is expected to come in at $80 per barrel across the second and third quarters, $81 per barrel in the fourth quarter, $78 per barrel in the first quarter of next year, $73 per barrel in the second quarter, $69 per barrel in the third quarter, and $65 per barrel in the fourth quarter, according to the note.

J.P. Morgan projects in the note that the Henry Hub gas price will average $2.05 per MMBtu in the second quarter, $3.00 per MMBtu in the third quarter, $4.00 per MMBtu in the fourth quarter, $4.75 per MMBtu in the first quarter of 2025, $4.50 per MMBtu in the second quarter, $4.75 per MMBtu in the third quarter, and $5.00 per MMBtu in the fourth quarter.

The company highlighted in the research note that the Brent price, WTI price, and Henry Hub price averaged $82 per barrel, $77 per barrel, and $2.45 per MMBtu in the first quarter, respectively.

In a previous research note sent to Rigzone on April 26, J.P. Morgan’s price projections were identical, excluding the second quarter and overall 2024 Henry Hub prices. In that note, the company forecast that the commodity would average $2.25 per MMBtu in the second quarter of this year and $2.93 per MMBtu overall in 2024.

In a separate research note sent to Rigzone late Tuesday, J.P. Morgan said the estimated value of open interest across energy markets increased by $6 billion week on week and reached $653 billion.

“The increase in crude oil and petroleum products was primarily driven by healthy inflows of $15 billion week on week (across all trader types), while mixed price actions across the curve in crude oil and petroleum products broadly offset each other,” the company stated in the note.

“Our oil strategists outline continued strong oil demand as most recently evidenced by 500,000 barrel per day increase in U.S. gasoline demand,” it added.

“The estimated value of open interest across natural gas markets increased by $5 billion week on week, as both U.S. Henry Hub and European TTF have rallied in price significantly, while net inflows across all trader types were more modest at ~$0.6 billion,” it went on to state.

In its latest short term energy outlook (STEO), which was released earlier this month, the U.S. Energy Information Administration (EIA) projected that the Brent spot price will average $87.79 per barrel in 2024 and $85.38 per barrel in 2025, the WTI spot price will average $83.05 per barrel this year and $80.88 per barrel next year, and the Henry Hub spot price will come in at $2.18 per MMBtu in 2024 and $3.09 per MMBtu in 2025.

The EIA’s previous April STEO forecast that the Brent spot price would average $88.55 per barrel this year and $86.98 per barrel next year, the WTI spot price would average $83.78 per barrel in 2024 and $82.48 per barrel in 2025, and the Henry Hub spot price would average $2.15 per MMBtu in 2024 and $2.89 per MMBtu in 2025.*

Compare J.P. Morgan’s reasoned predictions with the wild “earth is burning to a cinder” bullcrapus being peddled by Bloomberg. Which one do you believe? Our money is on J.P. Morgan.

Editor's Note: Natural gas prices are just like milk prices. When prices go up in response to increased demand, farmers add cows, more milk goes onto the market and the competition brings prices down. This, in turn, makes farming less profitable and farmers sell cows or go out of business, yielding to "get big, get weird or get out” iron law of commodities. Natural gas is no different. Commmodity producers need to get big enough to wait out price swings, find themselves a niche market or get out of the business. There are no other choices.

#NaturalGas #JPMorgan #GasPrices #Commodities #Bloomberg

For more great articles on natural gas development every single day, subscribe to Marcellus Drilling News using this convenient link.