Pittsburgh Works Together is an organization of union leaders and executives from the manufacturing, energy, and utility sectors as well as economic development professionals. It just put a thorough analysis of what is happening with the PJM electricity grid that encompasses the following states:

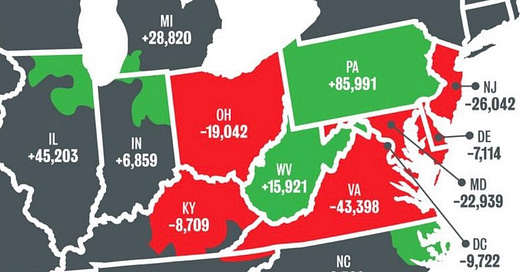

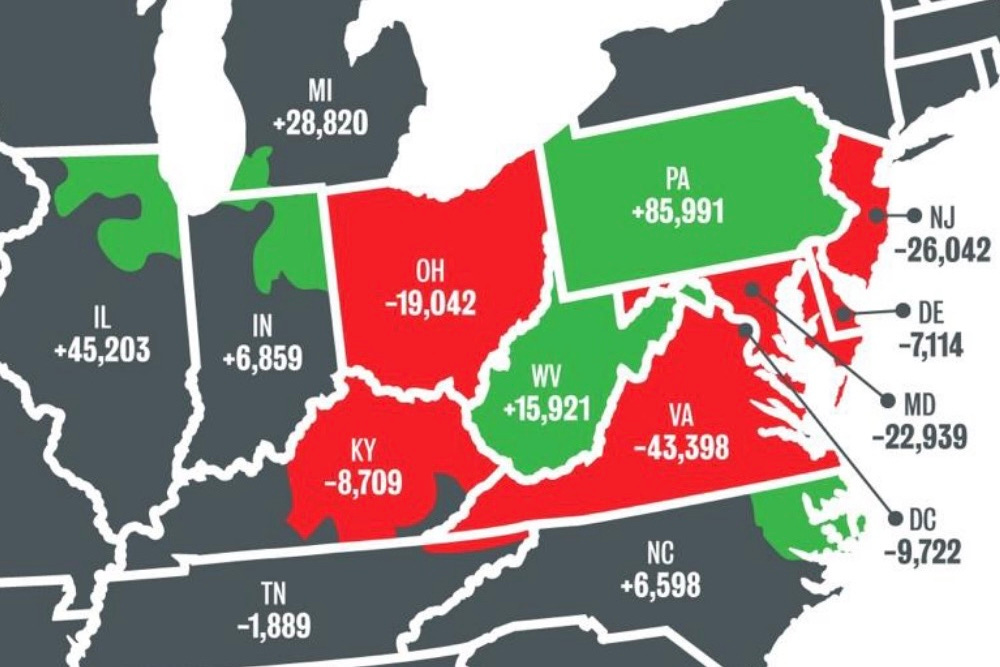

Pennsylvania is the big gorilla of power producers. The above map is PIttsburgh Works’ calculation of PJM net electricity transfers in gigawatt hours for 2023. It shows the combination of Pennsylvania and West Virginia export enough excess electricity to cover the bulk of the shortages in Delaware, Maryland, New Jersey, Virginia and the District of Columbia.

But, PJM energy security is very much endangered by the foolish political correctness of the leadership of Pennsylvania, among others. Read the whole 10-page report but here are the portions that get to the heart of the matter (emphasis added):

PJM has been sounding the alarm for several years, but policymakers continue to pull at the loose threads that will unravel the network.

PJM joined with other grid operators to try to educate the EPA on the impact that new greenhouse gas rules would have on grid reliability. The EPA agreed to temporarily hold off on any rules that would force the shutdown of the existing natural gas power plants that provide 40% of the country’s electric power.

But the new rules that ban existing coal plants and limit development of new gas-fired plants were too much for PJM.

“We are seeing vastly increased demand as a result of new data center load, electrification of vehicles and increased electric heating load. The future demand for electricity cannot be met simply through renewables given their intermittent nature,” PJM said in a May 8 statement. “The EPA has not sufficiently reconciled its compliance dates with the need for generation to meet dramatically increasing load demands on the system.”

A “fact sheet for policymakers” that PJM released earlier this year puts it this way:

Demand on the system, or load, is increasing. In recent years, demand projections had remained relatively flat within PJM. But due to the rise in electrification (e.g., the steady growth of electric vehicles and electric heaters in buildings) and the rapid proliferation of energy-intensive data centers, PJM is now forecasting significant long-term and medium-term load increases – more than 40,000 MW (megawatts) in the next 15 years.

At the same time, supply is decreasing. PJM sees significant generator retirements on the horizon due primarily to federal and state policies prompting the shutdown of fossil fuel resources earlier than their useful economic life; PJM expects to lose at least 40,000 MW of generation from retirements by 2030.

That’s 40,000 MW in load growth by 2039 and the loss of 40,000 MW of generation through retirements by 2030. The math is not good.

PJM – and the 65 million customers it serves – got a taste of that new math last month. PJM held its capacity auction for 2025-26, a kind of insurance payment to generators to be on standby in case they’re needed. The price paid at auction was nearly 10 times higher than the price paid in the same auction last year.

And two sub-zones within PJM, stretching across portions of Maryland, Virginia, and North Carolina, could not secure enough commitments to create a sufficient margin of safety.

“The significantly higher prices in this auction confirm our concerns that the supply/demand balance is tightening across the (PJM grid),” said Manu Asthana, PJM’s president and CEO.

Customers will pay the price, literally,

The Maryland Office of People’s Counsel, the government agency which looks out for the interests of the state’s residential utility customers, released a report this month on the impact the price spike will have:

• Customers across PJM will end up paying $12.2 billion more for the capacity guarantee from June 1, 2025, to May 31, 2026, than they are paying this year.

• Most Maryland residential customers will see their monthly electric bill jump by double digits, some by as much as 24%, starting next year.

These warnings from the operator of the country’s largest electric grid, coupled with an unprecedented price spike necessary to secure sufficient supply, would seem like a major story during this time of the country’s energy transition. Apparently not in the country’s most prestigious newsrooms.

The New York Times has written nothing about PJM’s concerns about the EPA rules, nor about the results of last month’s capacity auction. Neither has the Washington Post, the largest newspaper within the PJM service territory. Give The Wall Street Journal credit, though. It wrote about the surprising capacity auction, in a column about the impact it will have on energy company stock prices…

Natural gas and nuclear energy combine to account for 86% of Pennsylvania’s electric generation in 2022, according to the latest data available from the U.S. Energy Information Administration. Add in coal’s 10% share and that covers nearly every electron.

Wind accounted for 1.5% of Pennsylvania’s generation. Solar provided just one-tenth of 1%.

This mix may surprise those who are aware of Pennsylvania’s long-standing Alternative Energy Portfolio Standard [AEPS]. Passed in 2004, it requires that 18% of the power sold to Pennsylvania customers be wind, solar or other types of non-traditional generation.

Several factors account for the seeming contradiction. The law permits utilities and suppliers to purchase credits from out-of-state generators to cover some of their obligations. About 40% of the AEPS compliance credits in 2023 were purchased from out of state, according to the most recent analysis of the program produced by the PA Public Utilities Commission.

Also, unlike some states, Pennsylvania has an alternative energy standard, not a renewable energy standard. This was done so that electric generators could be part of an effort to clean up some of the state’s legacy environmental problems, such as waste coal piles.

In fact, about half of the AEPS credits last year involved generation from carbon-producing sources, including the burning of municipal waste, methane produced from rotting garbage at landfills, and wood chips.

Pennsylvania generates roughly one-third of the electricity produced in PJM, which means it directly powers about 7% of the country’s GDP. As such, what happens in Pennsylvania will have an impact far beyond our borders.

Gov. Shapiro has proposed sweeping new energy legislation that would reshape Pennsylvania’s power generation sector. The proposals could disrupt PJM operations in two ways:

• Charging a tax on Pennsylvania’s fossil fuel plants based on their generation, making them more expensive to operate.

• Requiring the sale of far more wind, solar, and other alternative-energy generated power to Pennsylvania customers.

The proposed Pennsylvania Climate Emissions Reduction Act (PACER) would tax the state’s fossil-fuel power plants based on their production. The purpose is to discourage carbon emissions and to raise money to finance new power projects with lower carbon emissions. The immediate impact would be to make the fossil-fuel plants more expensive to run, potentially reducing their production or pushing them into early retirement.

When the Wolf administration modeled the impact of a similar tax that would be charged under the banner of the Regional Greenhouse Gas Initiative, it showed the tax would cut production of Pennsylvania electricity and raise wholesale electricity costs. It also showed the tax would not cut emissions in PJM, because production would go to other states like Ohio and West Virginia.

The Shapiro administration has not publicly released any modeling analyzing the impact of PACER on production or cost or emissions reductions.

The proposed Pennsylvania Reliable Energy Sustainability Standards Act would replace the existing Alternative Energy Portfolio Standard. The new PRESS standard would de-emphasize some of the carbon-producing fuels now eligible, such as waste coal and garbage.

And it would impose a much greater requirement on the sale of wind, solar, and other noncarbon electricity to Pennsylvania consumers than the current AEPS. It would require that 35% of the power sold in Pennsylvania in 2035 come from a Tier I group that includes wind; solar; geothermal; advanced nuclear reactors; and methane from landfills and coal mines that is otherwise escaping untouched into the atmosphere.

Right now, just under 7% of the electricity sold in the state meets the proposed new Tier I definition. To comply with the proposed legislation, that total would have to double by June 1, 2026, and jump fivefold by 2035 to 35%.

By 2030, 10% of those Tier I sources would have to be located within Pennsylvania. If wind and solar are primarily used to satisfy that requirement, that would mean wind and solar production, which was 1.6% of Pennsylvania generation in 2022, would have to increase by 600% over the next six years.

The bulk of Tier I requirements could be satisfied by purchasing renewable generation from other states. That is exactly what other states, such as Maryland and New Jersey, are counting on as well – someone somewhere else is going to do it.

Except that’s not happening.

PJM said it has authorized 38,000 megawatts worth of new projects to connect to the grid, mostly wind and solar. They’re just not getting built. PJM said the reasons include a lack of financing, supply chain issues, and permitting delays.

“If this sluggish pace of development continues, PJM projects a shortfall in supply by the end of this decade – or sooner,” PJM stated in its fact sheet for policymakers.

It doesn't get much more clear than this does it? Josh Shapiro is happy to destroy the PJM grid and pass the costs along to consumers through hidden taxes; all to satisfy his obsession with climate political correctness.

#PittsburghWorks #Electricity #PJM #Grid #EnergySecurity #Shapiro

There isn't enough time to correct this politically manufactured energy shortage before we see some pretty nasty crises. It takes a long time to get new reliable power plants built. Sow the wind and reap the whirlwind - for the next several years.

“For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it? Otherwise, when he has laid a foundation and is not able to finish, all who see it begin to mock him, saying, ‘This man began to build and was not able to finish.’ Or what king, going out to encounter another king in war, will not sit down first and deliberate whether he is able with ten thousand to meet him who comes against him with twenty thousand? And if not, while the other is yet a great way off, he sends a delegation and asks for terms of peace.”

Luke 14:28-32 ESV

It’s always wise to “crunch” the numbers to see if plans will succeed. Ignorance is bliss until it impacts you and me.