PJM Auction Prices Show How Fragile Our Grid Really Is: The Rock and the Hard Place Are Both Coming Closer

I live in Pennsylvania, which is part of the PJM grid. Thus, I was startled by the following news from Reuters (emphasis added);

An annual power market auction by the largest U.S. electrical grid operator resulted in prices more than 800% higher than last year as supply dwindled and demand increased, the operator said on Tuesday.

PJM Interconnection, which covers parts of 13 states from Illinois to New Jersey, revealed the results of its 2025 to 2026 capacity auction. Prices for power plants landed at $269.92 per megawatt-day, compared to $28.92 per megawatt-day for year-ago auction, the grid operator said in a statement.

"The significantly higher prices in this auction confirm our concerns that the supply/demand balance is tightening," said PJM Chief Executive Officer Manu Asthana said. "The market is sending a price signal that should incent investment in resources."

The auction secured 135,684 megawatts for the period from June 1, 2025, through May 31, 2026. The power mix from generators included 48% gas, 21% nuclear, 18% of coal, 1% of solar, 1% of wind, 4% of hydro, 5% of demand response and 2% from other resources, PJM said.

Shares of independent power producers with nuclear fleets, including Constellation Energy, Vistra, and Talen jumped in after-hours trading following the auction.

Constellation shares were up about 10% to $185.10, Vistra rose 12% to $77.50 and Talen gained roughly 18%, according to Refinitiv Eikon data.

The PJM grid was previously rated as being in pretty good shape as to future reliability but these auction prices tell us there are deep worries about future supplies. And, utilities want reliable sources, which is why 86% of the electricity purchased will come from reliable baseload suppliers of electricity from natural gas, nuclear and coal. Solar and wind represent but 2% of that purchased.

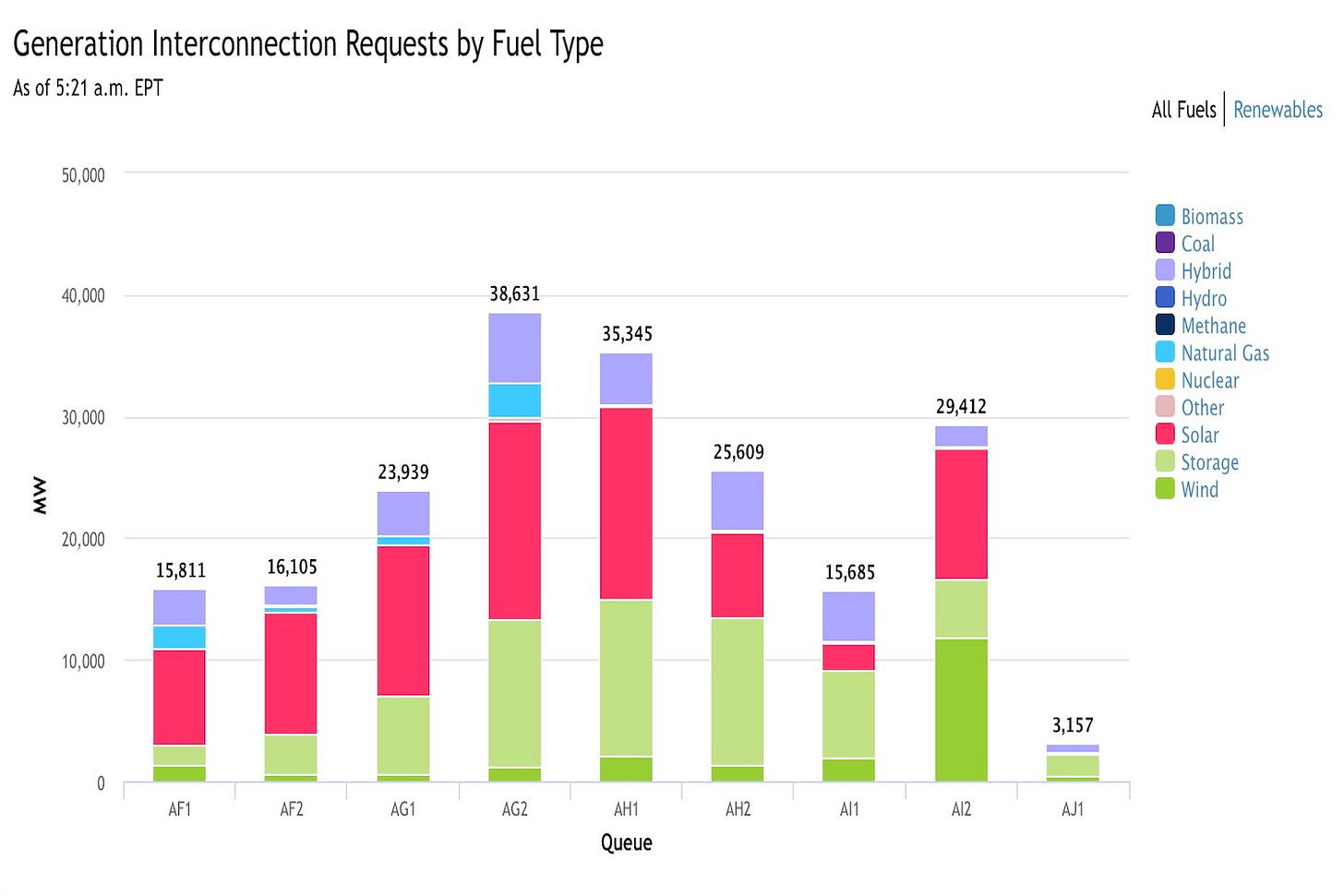

Now compare this with the energy sources being proposed for the PJM grid by energy developers:

If you look closely, you'll see there are no new nuclear or coal based projects being proposed and almost no natural gas projects either, despite the obviously high demand for them. Why? Because our insane governing bodies have made it harder at every moment to develop them.

PJM is saying the recent auction prices should incentivize more such development, but how can it when Federal courts are halting pipeline projects to analyze climate impacts, NGO’s such as the Heinz Endowments are pouring millions in harassment of all new projects and the governors of so many PJM states are playing the ‘energy transition’ games?

There are two things to be learned here. First, is the fact the rock and the hard place are coming ever closer together in the case of electricity supply and demand and consumers are being caught between. Electricity prices are going to go way higher. Secondly, PJM cannot afford to accommodate more solar and wind without baseload backup even though political correctness might seek it. Green energy is unreliable and no wants unreliability in the face of rapidly escalating future demand.

Push is going to shove and very quickly.

#PJM #Pennsylvania #NewJersey #Maryland #Grid

What is the point of having the intermittent providers on the grid? They will be stranded assets without the subsidies and mandates that enable them to drive out conventional power.

But only until the tipping point where there is not enough power to provide the base load on windless nights.

That is the end of the road to net zero because subsidies for wind and solar will have to go or state aid will be required to keep the conventional power plants running.

That is happening for gas in Texas and for coal.burners in two states in Australia.

The lunacy will end when a true crisis forces the apathetic public to wake up!