No Industry Innovates Like the Oil and Gas Industry and That's Why Green Energy Never Catches Up

The following chart and text from Today In Energy explain the innovation inherent in the oil and gas industry better than anything I can write. It shows why green energy never gets ahead of oil and gas and always need subsidies, although that’s not stated explicitly, of course.

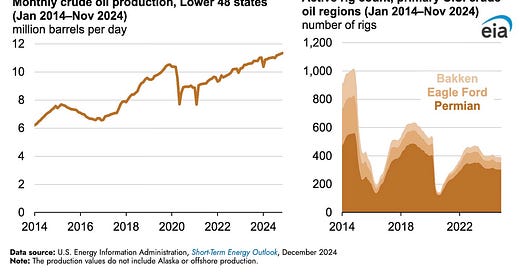

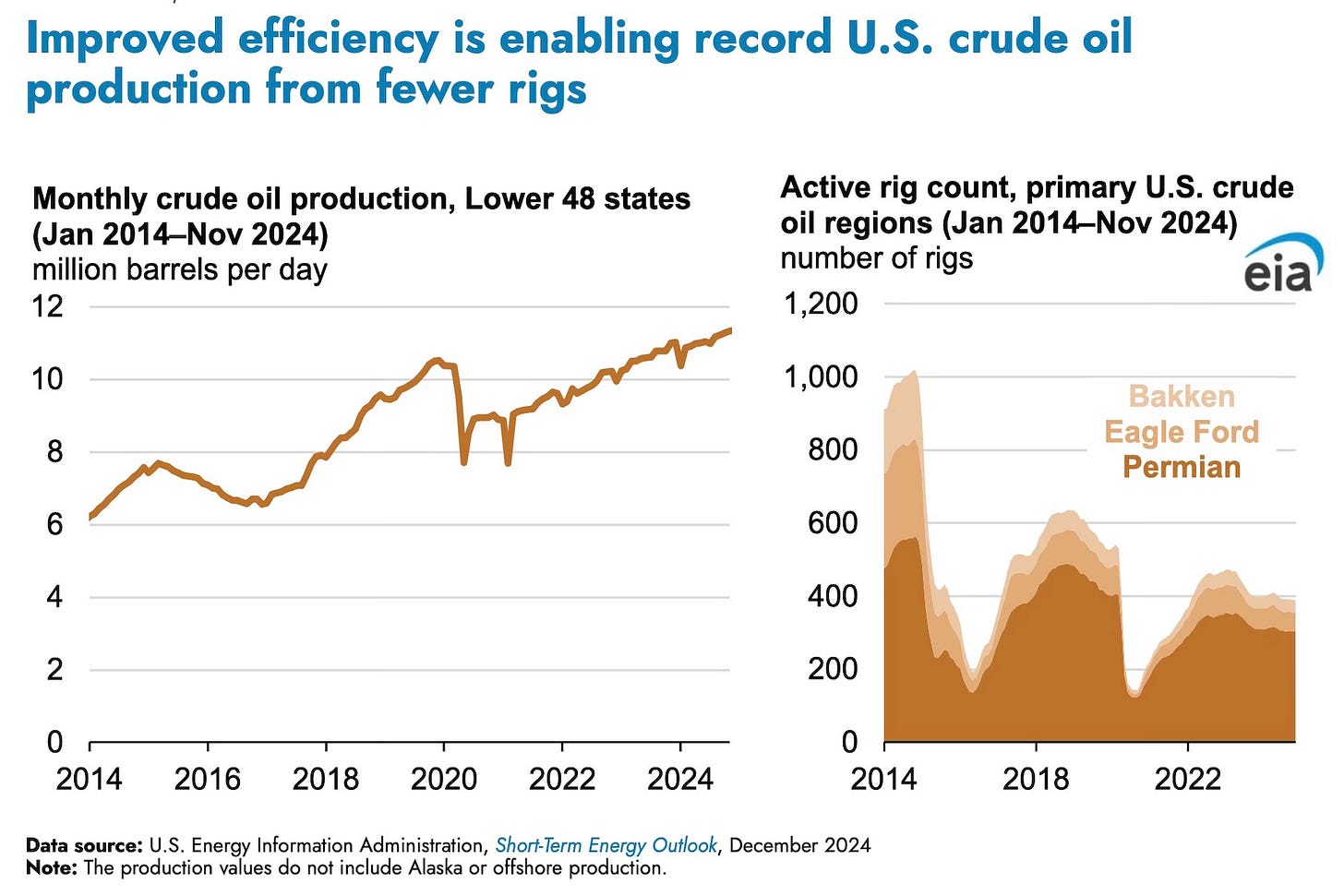

Crude oil production in the U.S. Lower 48 (L48) states, which excludes Alaska and offshore production, reached a record 11.3 million barrels per day (b/d) in November 2024, according to our estimate in the latest Short-Term Energy Outlook (STEO) published on December 10. Crude oil production in the L48 states increased 3% year over year despite fewer active rigs in most major producing regions, demonstrating gains in operational efficiency.

Rigs drill oil wells, and an increased number of active drilling rigs indicates that U.S. producers are drilling more wells, which generally results in growing oil production. Our latest STEO shows the active rig count decreased year over year in 2024 through November in all L48 primary crude oil producing regions except the Bakken. The region with the most activity, the Permian Basin, declined from 310 rigs to 303 rigs between November 2023 and November 2024.

The active rig count for these regions, which includes the Permian, Eagle Ford, and Bakken, declined 18% to 389 rigs since the recent January 2023 high. Data on 34 publicly traded exploration and production companies also suggest increasing well productivity is helping reduce companies’ production cost per barrel.

Oil and natural gas companies are increasingly leveraging technological advances, including artificial intelligence, electronic hydraulic fracturing technologies, and automated drilling processes, to optimize operations while operating fewer rigs, according to trade press. This shift toward digital solutions has improved drilling and completion techniques and reduced rig downtime, and it provides advanced analytics to help target future operations.

These technological solutions have allowed producers to increase production rates for rigs as they drill new wells. Improved performance is particularly evident in the Permian region, where we observed a 9% year-over-year increase in November’s crude oil productivity per active rig.

Once again, there’s nothing more to say.

#Oil #Innovation #Rigs #Permian #Bakken #EagleFord #GreenEnergy #Subsidies

Since there are more wells per rig it follows that production per rig increased. As long as the number of wells increases and production volumes are greater than the decline of existing wells the daily production volume will increase. As long as the commodity price stays above the magic number the drilling activity will stay at or above current rig activity. The magic number - high enough that operators cover their capital costs, operations cost, overhead cost, and make enough profit to generate distributions to shareholders and owners. That exact number is speculated on by many and the true test is when the commodity price declines and we then see rig activity decline.

It’s going to be an interesting year!

👊🗽🇺🇸