New York Is Now Out of Options for Reducing Emissions Using RGGI Unless It Chooses to Just Shut Stuff Down!

Guest Post by Roger Caiazza of Pragmatic Environmentalist of New York.

This is the second article in a series of three on the status of the New York component of the Regional Greenhouse Gas Initiative (RGGI) as administered by the New York State Energy Research & Development Authority (NYSERDA). This is timely because on December 18, 2024, the New York Assembly Committee on Energy held a public hearing to gather information about NYSERDA’s revenues and expenditures in order to gain a broader perspective on effectiveness of NYSERDA’s programs.

In the first article, I evaluated Environmental Protection Agency (EPA) emission data and NYSERDA documentation and found that the investments funded by RGGI auction proceeds would have been only 4.2% higher if the NYSERDA program investments did not occur. There are unacknowledged ramifications of this emission reduction performance relative to future NYSERDA program investments and RGGI compliance mandates.

Background

RGGI is a market-based program to reduce greenhouse gas emissions (GHG) (Factsheet). It has been a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont to cap and reduce CO2 emissions from the power sector since 2008. New Jersey was in at the beginning, dropped out for years, and re-joined in 2020. Virginia joined in 2021 but has since withdrawn, and Pennsylvania has joined but is not actively participating in auctions due to on-going litigation.

According to a RGGI website:

The RGGI states issue CO2 allowances that are distributed almost entirely through regional auctions, resulting in proceeds for reinvestment in strategic energy and consumer programs.

Proceeds were invested in programs including energy efficiency, clean and renewable energy, beneficial electrification, greenhouse gas abatement and climate change adaptation, and direct bill assistance. Energy efficiency continued to receive the largest share of investments.

On a quarterly basis permits to emit a ton of CO2 or allowances are auctioned by RGGI. The electric generating units that have RGGI compliance obligations must surrender one allowance for each ton emitted during the compliance period. In theory, States invest the proceeds to reduce emissions indirectly through energy efficiency programs and directly through the deployment of renewable energy that displaces fossil fired generation and supporting carbon abatement technology. This article describes the implications of NYSERDA RGGI program emission reduction effectiveness and funding priorities on these compliance obligations.

NY Electric Generating Unit Emission Reductions

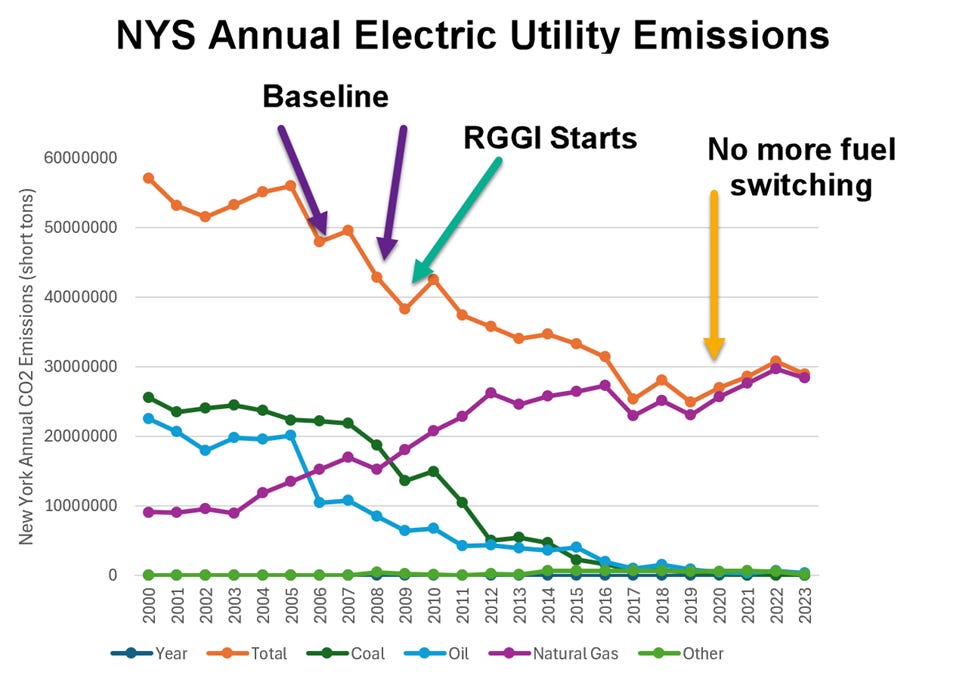

In my New York RGGI Funding Status Report Status Through 2023 post I used EPA emission data and NYSERDA documentation to determine the effect of the investments funded by RGGI auction proceeds. In 2000, New York EGU emissions were 57,114,439 tons and in 2023 they were 28,889,913 tons, a decrease of 49%.

Figure 1 plots these data and shows emissions by fuel type. Clearly, fuel switching is the primary driver of the observed reductions. Since the start of the RGGI program I estimate that emissions from RGGI sources in New York would have been only 4.2% higher if the NYSERDA program investments did not occur. The Figure 1 graph also shows that the opportunity to make further emission reductions by switching fuels is no longer available.

New York RGGI Program Investment Reductions

Table 1 lists data from Semi-Annual Status Report through December 2023 Table 2: Summary of Total Expected Cumulative Annual Program Benefits including the cumulative annual costs of investment programs and annual tons of carbon dioxide equivalent (CO2e) saved by the investments..

The report notes that:

“NYSERDA begins tracking program benefits once project installation is complete and provides estimated benefits for projects under contract that are not yet operational (pipeline benefits).“

The report presents “expected quantifiable benefits related to carbon dioxide equivalent (CO2e) reductions, energy savings, and participant energy bill savings with expended and encumbered funds” but I only consider the CO2e reductions. Note that the emission savings evaluated in the report include carbon dioxide, methane, and nitrous oxide. In the original table “lifetime” savings are included. I did not use “lifetime” savings data because I am trying to compare the RGGI program benefits emission savings reductions to the RGGI compliance metric of an annual emission cap. Lifetime reductions are clearly irrelevant.

NYSERDA RGGI proceed investments can produce CO2 emission savings from RGGI-affected electric generating units in two ways: directly by displacing natural gas generation by deploying zero-emissions resources or indirectly by reducing the amount of load that the affected units must provide.

I assumed the indirect investments reduced the load that directly offset RGGI-affected sources. This has been a good assumption because load growth has been stalled, but with the electrification of buildings and transportation and the addition of data centers and large load centers, the presumption that indirect NYSERDA investments will reduce emissions will become weak.

Table 2 compares the observed emissions to the NYSERDA emission savings. These results show that emissions from RGGI sources in New York would have been only 4.2% higher if the NYSERDA program investments did not occur. However, that estimate is an overestimate of the capability of NYSERDA investments to reduce RGGI-affected source emissions.

NYSERDA estimates of emission savings include methane and nitrous oxides, but RGGI compliance is only for CO2. The presumption that programs that indirectly reduce emissions has qualifications that reduce the actual reductions. The NYSERDA savings number also includes savings from programs that will not reduce RGGI-affected units’ emissions as shown in the next section.

New York State RGGI Funding Priorities

Table 2 overestimates relevant savings because of RGGI funding program priorities. The October 2024 New York State Funded Programs reportdescribes the funding priorities for the auction proceeds:

The State invests RGGI proceeds to support comprehensive strategies that best achieve the RGGI CO2 emission reduction goals. These strategies aim to reduce global climate change and pollution through energy efficiency, renewable energy, and carbon abatement technology. Deploying commercially available renewable energy and energy efficiency technologies help to reduce greenhouse gas (GHG) emissions from both electricity and other energy sources in the short term.

To move the State toward the goals enacted by the Climate Leadership and Community Protection Act (Climate Act) and a more sustainable future, RGGI funds are used to empower communities to make decisions that prompt the use of cleaner and more energy-efficient technologies that lead to both lower carbon emissions as well as economic and societal co-benefits.

RGGI helps to build capacity for long-term carbon reduction by training workers and partnering with industry. Using innovative financing, RGGI supports the pursuit of cleaner, more efficient energy systems and encourages investment to stimulate entrepreneurial growth of clean energy companies. All these activities use funds in ways that accelerate the uptake of low- to zero-emitting technologies.

Table 2 is misleading in the context of RGGI compliance obligations because not all the savings will affect RGGI emission sources. There is a significant fraction of RGGI funds that goes to programs that increase rather than decrease electric generating unit emissions.

In Table 3, I categorized programs relative to RGGI compliance obligations. The table breaks down the program allocations and expected annualized CO2 savings for three categories: direct reductions to RGGI sources, indirect reductions, and those programs that will actually increase electric generating emissions. For example, Charge NY is NYSERDA’s Clean Transportation Program that “has been pursuing five strategies to promote EV adoption by consumers and fleets across New York”.

The results in the Funding status reports show that since the start of the program NYSERDA has allocated $98.8 million to programs that directly reduce utility emissions by 199,733 tons, $702.7 million for programs that indirectly reduce utility emissions by 1,205,780, and $348.1 million for programs that will increase utility emissions by 678,804 tons.

In the last category, the GHG emission savings listed are the benefits for switching from gasoline and diesel to electric vehicles. When those savings that do not affect RGGI source emissions are removed, total savings are 1,297,297 and the emissions from RGGI sources in New York would have been only 2.8% higher if the NYSERDA program investments did not occur.

Discussion

The results of NYSERDA RGGI funding have important and unacknowledged ramifications.

The comparison of observed electric generating unit emission reductions by fuel type clearly show that historical reductions were the result of fuel switching. In addition, it is obvious that all that low-hanging fruit is gone. Nonetheless, many ill-informed voices are clamoring for stricter RGGI emission reduction trajectories begging the question – where will the emission reductions come from? It does not seem that NYSERDA RGGI investments will help the affected sources meet their compliance obligations.

I did not mention the observed cost per ton saved in Table 1. It is not very encouraging that NYSERDA program investments cost $582 for each ton saved. At that rate, New York will have to invest $16.8 billion to achieve the Climate Leadership & Community Protection Act 2040 electric sector zero-emissions mandate. In the first 15 years New York RGGI auction proceeds are a little over $2 billion based on the sale of 480.4 million allowances.

Assuming a RGGI straight line reduction to zero by 2040, 231 million total allowances will be allotted by 2040. At the $582 cost per ton rate the RGGI allowance price would have to be $73 per ton to provide sufficient funding to meet the compliance targets.

There is a huge assumption relative to the $73 allowance price funding necessary to achieve the zero-emissions by 2040 mandate. I assumed that all the RGGI proceeds would be allotted to programs that directly or indirectly reduce emissions at electric generating stations. Table 3 shows that for the programs that produce quantifiable benefits 32.6% of the proceeds go to programs that increase RGGI emissions. It is much worse than that. In my next article in this series, I will document how the latest Draft RGGI Operating Plan Amendment allocates funds to programs. Spoiler alert: only 22% goes to programs that will provide direct or indirect emission reductions.

Conclusion

This analysis of the latest NYSERDA RGGI funding plan document has important implications to New York’s plans to implement a Cap-and-Invest (NYCI) program. RGGI is touted as a successful model for NYCI to emulate but the poor emission reduction performance suggests that the presumption that NYCI will be an effective emission reduction program is misplaced.

There is another important issue. NYSERDA has not acknowledged that electric generators have no options to reduce their emissions to comply with RGGI. In the future those facilities can only meet compliance requirements if zero-emissions resources displace their generation and emissions. If there are insufficient investments to reduce generation at the RGGI-affected sources there will be compliance issues. The only option for affected sources to comply is to reduce or stop operations.

Roger Caiazza blogs on New York energy and environmental issues at Pragmatic Environmentalist of New York. This post represents his opinion alone and not the opinion of his previous employers or any other company with which he has been associated. Roger has followed the Climate Leadership & Community Protection Act (Climate Act) since it was first proposed, submitted comments on the Climate Act implementation plan, and has written over 480 articles about New York’s net-zero transition.

#ClimateAct #Caiazza #NewYork #Climate #RGGI #NYSERDA #Emissions

Thank you for your detailed analysis. I don’t live in New York but I’m wondering how more voters could be made aware of these facts to ask their representatives to take them into account. Similar analyses are needed all over America (and the world) but rarely seen.