The Lake Erie Energy Development Corp. announced that it was shelving plans to build six wind turbines in Lake Erie offshore of Cleveland, Ohio. The project was in the works since 2009 but was suspended after losing financing and development partners.

The U.S. Department of Energy, which gave the company a $50 million grant in 2016, revoked the money due to the Icebreaker project’s lack of progress in meeting grant performance milestones, according to Inside Climate News. The developer is refunding about $37 million of it; the American taxpayer is on the hook for the rest.

The company blamed the delays on years of “frivolous and costly lawsuits” and to increased interest rates and capital costs. Higher interest rates have driven up financing costs. General inflation and global circumstances have significantly increased capital costs, especially for materials like steel, making offshore wind particularly susceptible to economic fluctuations. Project delays also prompted Fred Olson Renewables, a Norwegian developer which had planned to build and operate the project, to also cancel out.

According to the developer, Icebreaker became “financially untenable” after the Ohio Power Siting Board in 2020 required the turbines to stop at night between March and November to reduce the risk to migratory birds and bats from the spinning turbine blades. While that decision was reversed, it became a topic for lawsuits by migratory bird advocates. The American Bird Conservancy and Black Swamp Bird Observatory were two organizations that opposed the Icebreaker project.

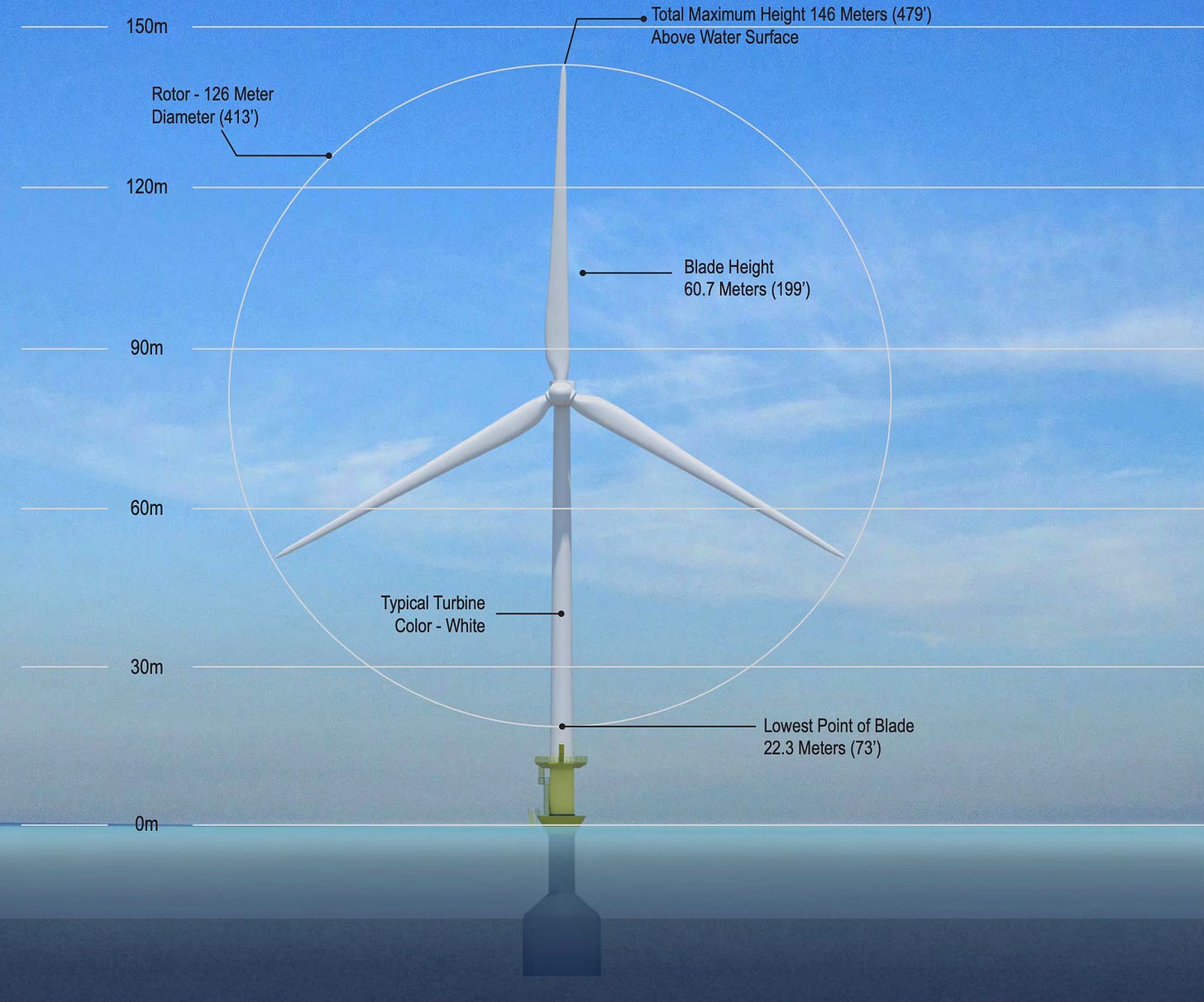

Icebreaker, a demonstration-scale project, would have been the first to erect offshore turbines in the Great Lakes and the first freshwater offshore wind farm in North America. The turbines were to be located eight miles offshore. They were to generate about 20 megawatts of electricity at full capacity —130 times less than the capacity of Ohio’s largest coal plant. The project would have to also overcome the elements including icing and winter conditions. Icebreaker would have been connected to Cleveland Public Power’s high-voltage grid. New York is considering an offshore wind farm on Lake Erie.

Interest in Offshore Wind Has Waned

A few years ago, interest in offshore wind energy was so strong that developers proposed spending tens of billions of dollars for hundreds of turbines in the Atlantic Ocean from Maine to Virginia. Several of those projects, however, have been canceled due to inflation; rising interest rates driving up borrowing cost; and supply chain problems, making parts more expensive.

The industry is finding it much more difficult to manufacture, transport and erect wind turbines than it had expected. And it is often expensive and difficult to transport wind power to dense coastal cities and suburbs. About two dozen turbines have been installed in U.S. waters, compared with more than 6,000 in Europe, which has been building offshore wind farms for decades by offering huge subsidies and incentives such as feed-in tariffs.

So far, Eastern states have awarded contracts to build about two dozen offshore wind farms with 21 gigawatts of electric capacity. But developers have canceled or asked to renegotiate rates for nearly half that capacity. Now, about 15 gigawatts of offshore wind is expected to be installed by 2030, half of President Biden’s goal. Europe has installed about 32 gigawatts of offshore wind capacity already.

Orsted, a Danish company that has built around two dozen offshore wind farms, mostly in Europe, has canceled two wind farms planned for waters off New Jersey and is reconsidering two more intended to serve New York and Maryland. A final blow to the NJ projects came when it became clear that a ship that the company had booked to install the foundations anchoring the huge turbines to the sea bottom in 2024 would not arrive on time.

The company said it would be writing off as much as $5.6 billion. BP, which paid $1.1 billion for a 50 percent stake in the Norwegian energy company Equinor’s U.S. offshore wind portfolio in 2020, recently wrote off $540 million of its investment.

Orsted recently began producing electricity for Long Island from a small offshore wind farm called South Fork Wind, and the company moving ahead with developing Revolution Wind, a $4 billion project that will provide power to Rhode Island and Connecticut. But the company is still deciding how to proceed with a different project in New York called Sunrise Wind, which may no longer be economically viable under its previous contract.

At an auction held by New York in October, the three winning companies offered to sell power to utilities at rates that were roughly one-third higher than earlier awards. Massachusetts and Connecticut now allow contracts for new offshore wind projects to be adjusted for inflation that occurs before construction starts. States are also anticipating higher prices, which translates into higher rates for consumers.

Dominion Energy, a large utility in Virginia, is moving ahead with a large wind farm, consisting of 176 turbines, and is spending $625 million on the first U.S.-built ship capable of hauling the more than 300-foot-long blades and other components for wind turbines out to sea.

The new 472-foot-long ship, Charybdis, is months behind schedule and will cost the utility about 25 percent more than initially projected. A longstanding federal law, the Jones Act, requires that only domestically built, owned and staffed ships can operate in U.S. waters.

Charybdis will be able to carry four to eight wind turbine components at once, depending on the size of the pieces. The ship’s crane can lift 2,200 tons — roughly the weight of six Boeing 747 jets. With the ship, the company would be able to set up one turbine a day. In 2020, it took the company a year, installing two offshore turbines because the company had to use European ships that it operated from a port in Nova Scotia, more than 800 miles away.

The Charybdis, which is being built in Brownsville, Texas, is about 70 percent complete, and Dominion expects to have it available for Orsted’s Revolution Wind project, near the Connecticut coast. The ship would then move to Dominion’s Virginia project, which the company plans to complete by the end of 2026.

Conclusion

Another offshore wind project is calling it quits as inflation, interest rates, supply chain issues and legal challenges are making it too expensive and difficult to proceed. This project is a demonstration project in Lake Erie, off Ohio, that would have been the first offshore wind project in fresh water.

Offshore wind is facing problems resulting in only half of President Biden’s goal for offshore wind able to be reached by 2030. Rather than 30 gigawatts, it is more likely that 15 gigawatts of offshore wind power will be erected. Wind developers are canceling projects because they cannot make the technology economic at the original rates in their contracts, paying fines instead. They plan to rebid as several states were not willing to renegotiate existing contracts higher.

#Icebreaker #Wind #WindEnergy #OffshoreWind #Subsidies #Dominion #LakeErie #DOe #Biden

Upwards of 20 million people draw their drinking water from Lake Erie and Lake Ontario. Imagine spraying tens of thousands of gallons of ethylene glycol to free the frozen blades in winter. Ooops that drops into the water supply. And Lake Erie, being shallow, usually freezes over in winter. Imagine what the ice would do to the tower bases. Anyone who uses the Lakes has seen the ice damage to the piers and docks. And the damage to the habitat when tearing up the bottom for the tower base? And the fog and water temperature changes generated by the turbulence (now documented in the ocean)? And how will these clouds affect rain and snow downwind? More Lake Effect? And when one of the turbine burns or crashes into the water: oops, we have poisoned Cleveland's water supply. Sorry about that. And Buffalo's and Hamilton's and Toronto's and Rochester's and etc. . And when those great storms of the winter and summer tear off a blade or two, do they yell 'fore' to sail boats and fishermen and then duck? Oh, and there are water spouts twisting over the Lakes in the Summer. What fool ever thought that this would be a good idea? I believe New York State has already said 'probably not' for Lake Ontario.

“Demonstration project” is accurate as we are clearly witnessing the shortcomings of this poorly conceived money laundering scheme known as offshore wind.