How AI Can Help Us to Unravel and Explain the Big Fat Green Energy Lie About Lowering Electric and Heating Bills

Artificial intelligence has many issues that I intend to talk or write about in the not-too-distant future, but I use it frequently, as readers know, to find and synthesize information. It has to be checked, of course, but it’s really good in pulling things together, if you will, and far superior to simple internet searches. Nonetheless, it’s good to test it frequently for not only accuracy but also bias, so I made a test regarding electricity prices to see if AI could nicely explain why electricity prices are rising.

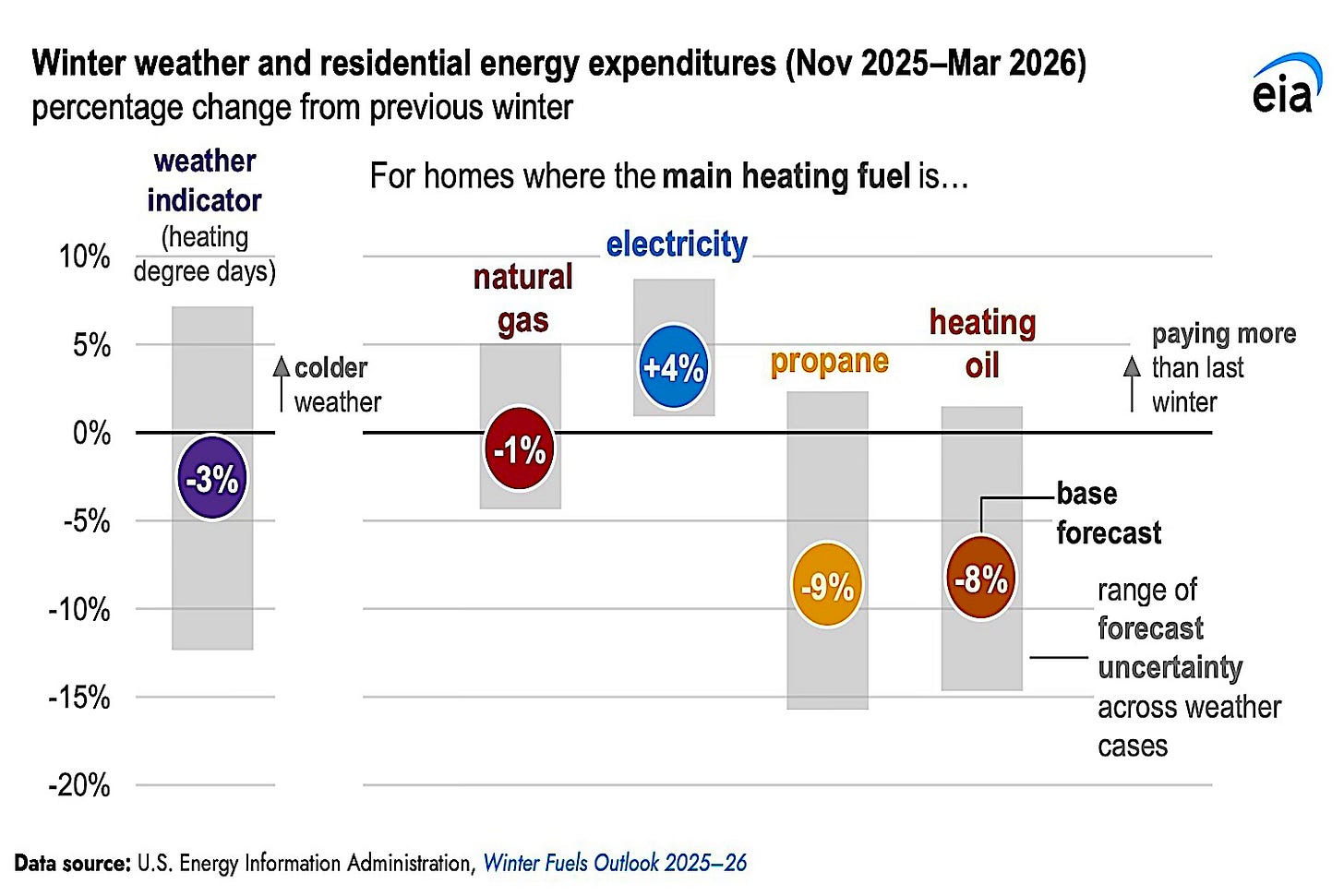

What prompted me to do so was this Today In Energy post about those prices. It included the following chart:

What caught my attention was the fact natural gas heating costs are projected to decline slightly, while electric heating costs are expected to rise four times as much. Knowing what I knew to be the answer, I asked both Grok and Perplexity the following question:

Why are electricity prices are projected to go up 4%, in this article, when natural gas prices are projected to decline, given that so much electricity is made using natural gas?

I essentially got the same answer from both AI sources, but Perplexity’s was more succinct:

Electricity prices in the U.S. are projected to increase about 4% even though natural gas prices are declining because electricity costs are influenced by multiple factors beyond natural gas fuel costs.

Key reasons for electricity price increases despite lower natural gas prices:

Electricity generation costs include not just fuel (natural gas) but also transmission, distribution, and other utility infrastructure costs that are significant and can rise independently of fuel prices. For instance, investments in grid maintenance and upgrades drive costs upward.

The residential sector’s electricity prices tend to grow faster than other sectors due to smaller and less predictable demand volumes and the high cost of reliance on local distribution systems.

Rising demand for electricity, driven by factors like expansion of AI data centers, electrification of transportation, and space heating, elevates prices even if fuel prices fall.

Weather conditions, regulatory factors, and the need for more power capacity (estimated 15% more capacity by decade-end) also pressure retail electricity prices upwards.

While natural gas prices have declined, retail electricity prices have recently increased rapidly due to these broader supply and demand and infrastructure factors.

In contrast, natural gas bills include substantial fixed costs related to infrastructure and delivery, which may not decline even if the fuel cost decreases; hence gas bills sometimes remain steady or even rise despite lower natural gas prices.

This explains the divergence: natural gas prices falling does not necessarily mean electricity prices will follow, given the complex cost structure of electricity retail pricing and rising non-fuel cost pressures plus increasing demand.

The answers were fine insofar as what they said, but left out the most important factor in my view, so I asked a follow-up, albeit leading, question:

Why aren’t you addressing the impact of intermittent renewables which, as duplicative energy sources, destroy the efficiency of coal and gas?

Again, both answers were good and very much the same, but Grok’s was more detailed:

The impact of intermittent renewables (like solar and wind) on the efficiency of coal and natural gas plants is a valid concern and contributes to the divergence between declining natural gas prices and rising electricity prices.

Here’s a concise explanation of why this dynamic matters and how it ties into the 4% projected electricity price increase in 2025, despite lower natural gas price forecasts, as per the EIA’s October 2025 Short-Term Energy Outlook (STEO).

Impact of Intermittent Renewables

Reduced Efficiency of Fossil Fuel Plants:

Intermittent renewables (solar and wind) are projected to account for 24% of U.S. electricity generation in 2025 (up from 23% in 2024), adding over 85 billion kWh. Their variability requires coal and natural gas plants to cycle more frequently (ramping up/down to balance supply when renewables drop off, e.g., at night or during low-wind periods).

This cycling reduces operational efficiency, as coal and gas plants are designed for steady, baseload operation. Frequent starts and stops increase wear-and-tear, raise maintenance costs, and lower fuel efficiency, leading to higher per-unit generation costs. For example, coal plants, which see a 15% consumption uptick in early 2025, face efficiency losses when backing up renewables.

Grid Balancing Costs:

Intermittency necessitates additional grid services like spinning reserves and fast-ramping gas peaker plants, which are less efficient and more expensive to operate than baseload gas units. These costs are passed to consumers, inflating retail electricity prices despite cheaper natural gas (forecast at $3.40/MMBtu in 2025, down 2.8% from prior STEO estimates).

Grid operators also invest in backup systems or storage (e.g., batteries), which add to infrastructure costs. The STEO notes rising transmission and distribution expenses, partly due to renewables integration, contributing to the 4.3% retail price hike (13.00 to 13.56 cents/kWh).

Duplicative Capacity and Stranded Costs:

Renewables act as “duplicative” sources when fossil fuel plants must remain online to ensure reliability, even if underutilized. This redundancy increases system-wide costs, as utilities maintain coal and gas capacity (e.g., coal’s 17% generation share in 2025) to cover renewable intermittency, yet these plants operate at lower capacity factors, spreading fixed costs over fewer kWh.

Investments in new renewables (solar up 18%, wind up 5% in 2025) alongside existing fossil infrastructure create stranded costs, as some coal and gas plants are retired early or run inefficiently, further pushing up rates.

This is a great summary and needs to be communicated more frequently and with regularity to instill a higher energy IQ among the general public. The dirty secret of renewables, that they raise electricity costs, even though the sunlight and wind are disingenuously described as free, is finally getting out, but we cannot relent in exposing it until every damned new solar and wind project is canceled for lack of subsidies. It’s also important to remember those subsidy costs are not included in any of the above calculations, which means the divergence in total costs is far greater than we’re usually told.

What can we learn about AI from this little test? Well, it’s generally good, but, at a minimum, one must to use it effectively:

Possess a working knowledge of the subject so as to be able to evaluate whether the answers resonate as correct and unbiased, and

Always push the AI program to provide more by challenging its answers, never accepting the first answer as the final verdict.

Given this understanding, it’s easy to see why AI is so useful in doing what it does best, finding stuff and integrating it. It served in the above case as an excellent tool in neatly summarizing why everything the green energy evangelists and grifters tell us about how it will lower electricity and heating costs is one big fat lie.

#Electricity #HeatingCosts #ElectricCosts #TodayInEnergy #AI #Grok #Perplexity #GreenEnergy #Renewables #Intermittent

Excellent article Thomas, and great follow up’s from Ron & Ed. AI is coming, but it appears to be coming without a plan. From what I am seeing on the internet these AI Centers are being constructed anywhere the owners can see easy and cheap methods of getting what they need, power and water. Our governments are being just as stupid it seems by encouraging them with all sorts of tax breaks to build in their back yard. Nobody is talking to the neighbors.

I am from the old school am am still learning to use Chat and Grok. I can see the future potential, but how much of my life are we expected to give up for it?

When I buy a new truck or car or motor home is someone else going to pay for my fuel so I get to use it? Somebody is seeing big potential $$ in this. Let them dig a little bit deeper and create this AI in a planned and organized way so that people can say “this is fantastic “ instead of what I am hearing and seeing on the internet.

Our grid is not ready for this AI requirement, so they have to work around it. The American public is not willing to pay for it. They have to pay for it. They will get their returns later.

I really like the idea of Community Power Plants constructed by the AI Groups. Power can be delivered on dedicated power lines owned by the AI Groups. New homes and subdivisions will be constructed for employees. People moving next to these facilities will know what to expect.

That’s my 2 bits worth. What must be done if this is an agreed upon route to seeing it move in this direction?

The demand for high speed transportation in urban areas has been witnessed by many over the years as interstate highways expand, experience maintenance issues and congestion. The overall impact is increased time for arrival at the destination.

With electrical power, the experience island expectation is instantaneous arrival of electrons when the user activates the switch or other devices. The “highway/interstate” flow of electrons is being challenged as renewables are being located further from the large urban areas, and they’re intermittent at best. The requirement for reliable but intermittent/standby spinning reserves is similar to the hybrid car concept with two sources of power. However, I think the gasoline engine in hybrids has the priority while the electric drive in hybrids is secondary. I’m not sure if this analogy has any applications for the current power generation systems.

Many are saying the answer is to install battery-backup devices or generators (gas-powered) at the site (home, business, etc.) and I plan to do this currently as I am building my new home (but see decreased reliability and increasing cost with the power utility in my area).

Most folks cannot afford to do this and should not have to do this…but this is where net zero aspirations are taking us.

With gas-powered vehicles, I carry a ready source of energy in my gas tank. With electric vehicles, I carry a ready source of energy in my batteries. Which source is more reliable and can sustain itself for longer periods of time and which source can be more easily replenished when it runs low? I’m going with gasoline.

I think the net zero aspiration has demonstrated its limited ability versus natural gas and coal. It’s reflected in the EIA data.