Planning Engineer Russ Schussler writes at Judith Curry's site to correct the record on the real costs of solar and wind energy. The following is a consolidated version of the story. I also substituted a more legible version of the chart Schusser used to make his point.

Wind and solar power are often touted as the cheapest sources of electricity in many regions, capable of delivering low-cost energy for the vast majority of the time. At first glance, this might suggest that an energy mix heavily weighted toward renewables would be the most economical choice.

However, this assumption overlooks a critical issue: the fat tail problem. Just because a resource is cheaper most of the time does not mean it reduces overall system costs. This post, the first in a series, explores why prioritizing wind and solar can lead to higher costs, starting with an analogy from the financial world.

The Fat Tail in Finance: A Cautionary Tale

To understand the fat tail problem, let’s consider a financial scam once common in late-night infomercials: “Make money on over 90% of your trades—guaranteed!” These ads promised that with their trading strategy, you’d win on 90% of your trades and lose on less than 10%. Sounds like a surefire path to wealth, right?

Not so fast, this is too easy. The flaw lies in the magnitude of the wins and losses. Investments often rise gradually but can plummet dramatically. If you make small gains 90% of the time but suffer massive losses the other 10%, the overall result can be catastrophic. The percentage of winning trades is a poor metric for profitability when the losses are disproportionately large. This is the fat tail problem: rare but extreme events drive the economics.

The Fat Tail in Power Systems

Just as rare but massive losses in trading can wipe out gains, peak demand periods in power systems drive costs that overshadow renewables’ savings during easy times. Electricity demand fluctuates, and supplying power is far more challenging—and expensive—during certain periods. At the end of this post, I have provided a more detailed and quantitative discussion as to how and why the fat tail becomes a major factor impacting energy costs. So as not to lose many readers, I will proceed with a more generalized description here.

Typically, the most difficult times are peak demand periods in winter and summer, which account for less than 5% of the year. During a single hour of peak demand, electricity costs can spike orders of magnitude higher than the typical average cost, forcing utilities to rely on expensive backup plants that sit idle most of the year.

For example, during the January 2014 Polar Vortex, a massive cold snap gripped the eastern U.S., driving electricity demand for heating across the PJM Interconnection to record levels. With no spare power to share among states, wholesale prices soared to $2,000 per megawatt-hour, over 60 times the typical $30/MWH average. Smaller localized events are more common with less drastic price fluctuations, but they contribute as well to the fat tail problem.

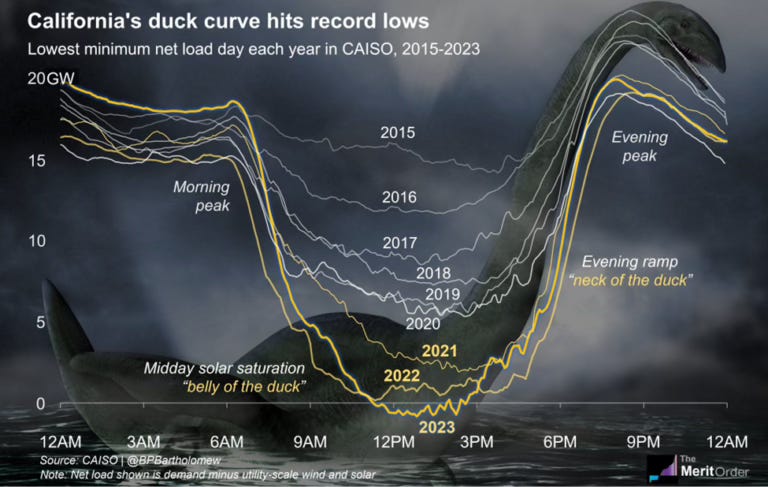

These types of scenarios can be greatly worsened by the duck curve as illustrated and described below.

As a worst case, imagine the duck curve scenario on a peak summer day. As consumers need more and more electricity commercial and home solar drop off significantly requiring a massive fast ramping from an array of dependable generation resource. For annual peak conditions, large costly resources, that may not be needed again all year might have to be called into service at great cost. For a winter peak a similar situation happens just before daybreak. High levels of electricity are required as individuals, businesses and factories deal with oppressive cold and prepare for the coming day.

In contrast, “easy” times, when demand is low and supply is abundant, make up 90% or more of the year and this is where energy and variable cost average are set. It’s a completely different story during hard times for demand and fixed charges. Historically, a single hour of peak demand could determine a utility’s annual peaking charges, highlighting the outsized impact of these extreme conditions.

Wind and solar often shine during easy times, producing electricity at a lower marginal cost than traditional sources like natural gas or nuclear. However, their output is intermittent and less reliable during peak periods, when weather conditions may not align with demand. Relying heavily on renewables requires backup systems—often expensive fossil fuel or nuclear plants—to ensure reliability during these critical fat tail events. The cost of maintaining these backup systems, combined with the infrastructure needed to integrate intermittent renewables, can greatly outweigh the savings from cheap renewable energy during easy times.

As I’ve noted before, “Energy ‘plans’ that call for wholesale changes but do not consider how the final overall system might work are not plans but rather only naïve wish lists.” Policymakers often push wind and solar based on their low costs in favorable conditions, ignoring the fat tail problem and the higher system-wide costs that result.

A Car Analogy: Efficiency/Marginal Costs Aren’t Everything

Consider a practical example. Imagine you’re choosing between two cars. Car A is fuel-efficient and meets your needs 90% of the time, but 10% of the time, you need Car B, which has more power and extra seating. Car B is less efficient, but it’s essential for those critical moments. Would you also buy Car A just because it’s cheaper to operate 90% of the time? Probably not—owning two cars would likely cost more than paying the extra fuel costs for Car B alone.

Similarly, building wind and solar farms to supply cheap energy during easy times doesn’t eliminate the need for reliable resources like natural gas or nuclear during peak periods. The added costs of constructing, maintaining, and integrating renewables—while still paying for backup systems—often make the overall system more expensive. Detailed power system modeling and real-world experience confirm this, yet the misconception persists that renewables’ low marginal costs guarantee economic benefits.

Talking Past Each Other

The fat tail problem may explain why energy debates often feel like ships passing in the night. Proponents of renewables emphasize their low average costs, while generation planners focus on the system-wide associated with the full array of needed generation resources. This disconnect stems from a kind of innumeracy—failing to go beyond average costs to account for the disproportionate impacts of serving peak periods and rare costly events.

In a sad case of common sense gone wrong, Renewable Portfolio Standards (RPS) and similar mandates were enacted under the assumption that renewables are inherently economic. The experts’ models showed otherwise but were often dismissed as biased since they didn’t reflect the value of the “cheap” renewables. In reality, they reflected the fat tail’s harsh arithmetic. This critical insight was overlooked by too many policymakers focused on short-term goals, advocates driven by enthusiasm, and academics unaware of real-world considerations.

Why do financial scams, which also exploit fat tail misunderstandings, fool fewer people than renewable energy promises? Perhaps energy systems’ complexity obscures the fat tail problem, while emotional appeals and trusted institutions lend renewables undue credibility. Also, unlike personal investments, energy policy involves collective costs, perhaps reducing individual scrutiny.

Modern civilization needs electricity most all of the time. Otherwise wind and solar would be a better deal. But having energy 80% or 90% of the time is not enough. Although there are many programs and approaches employed to limit electric use during peak times, large amounts of electricity are not shiftable away from peak periods. Consumers need cooling when it is hot and heating when the temperature is frigid. Those needs ensure the fat tail can’t be significantly slimmed down.

To be clear, I don’t think the issues have commonly been discussed in terms of fat tails. We’ve had a lot of engineers and financial analysts speaking in terms of system costs, that went past and over the heads of the relevant audience. The rebuttals of academics and advocates, as to the economics of wind and solar, have puzzled the engineers and financial experts who generally have not had the clout to cross examine and seek to find clarification. In most cases policy makers with or without needed understandings had the power and made the decisions based on overly optimistic expectations for wind and solar. A word to the wise – those speaking only in terms of average costs should not be trusted in decision making for complex systems. Beware of misleading metrics

#DuckCurves #FatTails #Renewables #ClimateChange #Solar #Wind #JudithCurry #RussSchussler #Costs