Canada's Atlantic Provinces Have Enormous Shale Gas Potential. Why Isn't Development Being Allowed?

The Fraser Institute is doing a great job in advocating for rational energy policies in Canada. It has, for example, just released an excellent report documenting the tremendous potential of the nation’s Atlantic provinces to produce huge volumes of natural gas:

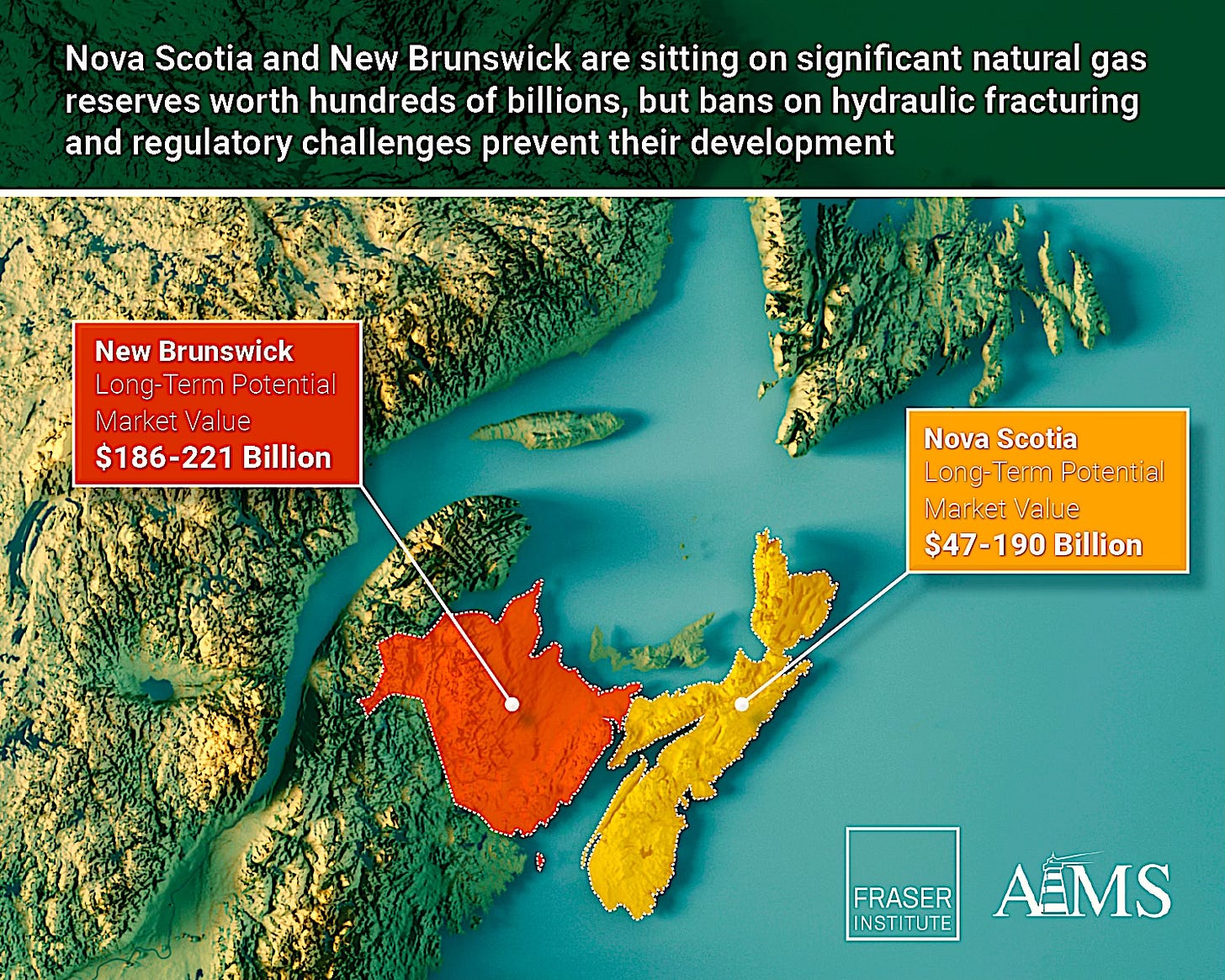

Both Nova Scotia and New Brunswick possess billions of dollars’ worth of shale gas potential, but bans on hydraulic fracturing are preventing the region from fully benefitting economically from the resource, finds a new report published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Nova Scotia and New Brunswick are sitting on significant reserves of unconventional natural gas that could be developed via hydraulic fracturing and generate immense benefit to a region that could use an economic boost,” said Kenneth Green, Fraser Institute senior fellow and author of Hydraulic Fracturing: Opportunities for Atlantic Canada.

The study finds that Nova Scotia and New Brunswick have billions’ worth of untapped shale gas potential.

In fact, shale gas potential at the Horton Bluff in Nova Scotia ranges from 17 to 69 trillion cubic feet (Tcf), which has a potential long-term market value of between C$47 billion and $190 billion. New Brunswick’s Frederick Brook shale formation alone has been estimated to hold between 67.3 to 80 Tcf of gas, which could be worth between C$186 billion to $221 billion in potential long-term market value.

The development of these resources, as they’re developed elsewhere in Canada and the United States, would mean billions of dollars of private investment and the jobs that accompany them as well as new provincial government revenues.

Recently, governments in the region have signalled an openness to removing moratoria on the development of this key resource. To date, bans on hydraulic fracturing have largely prevented the development of shale resources in the Atlantic provinces, along with the significant economic opportunity it would provide.

“This type of development in New Brunswick and Nova Scotia would mean more jobs close to home, and more investment overall,” Green said. “Removing the fracking bans would be a good first step in sending a signal that these provinces are ready to responsibly develop their shale gas potential.”

Key points from the study include the following:

Atlantic Canada has significant reserves of unconventional natural gas, which could be developed via the technology of hydraulic fracturing.

A 2017 report by the Canadian Energy Research Institute estimates that onshore, primarily shale gas potential in place at the Horton Bluff in Nova Scotia ranges from 17 trillion cubic feet (Tcf) to 69 Tcf. At current market prices for natural gas, this reserve would represent a market value of between $47 billion and $190 billion.

Nova Scotia’s Frederick Brook shale formation has been estimated to hold between 67.3 Tcf to 80 Tcf of gas in place. At current market prices for natural gas, this reserve would represent a market value of $186 billion to $221 billion.

Newfoundland & Labrador, as well as Prince Edward Island, are believed to have unconventional shale gas potential as well, though no firm estimates have been developed.

Moratoria on hydraulic fracturing instituted in 2013–2014 remain in place in the Atlantic provinces, preventing the development of Atlantic Canada’s shale resources and leaving potentially large economic gains trapped underground.

The removal of those moratoria would certainly be a first step in sending a signal that Atlantic Canada might be open for hydraulic fracturing gas development. However, it might not be enough to spur development of the resources. Environmental regulations such as the Impact Assessment Act, Canada’s Net Zero 2050 framework, the Clean Electricity Regulations, and opposition from Aboriginal groups would all pose barriers to natural gas development.

I have long been interested in New Brunswick, having posted numerous articles at Natural Gas NOW on the battles there to develop shale gas, so I was particularly interested in the following from the report:

Hydraulic fracturing became an election issue in New Brunswick in 2014, which led to a ban on hydraulic fracturing, followed by a commission to review the practice (NBCHF, 2016). In 2018, the government under Premier Blaine Higgs (2018– 2024) proposed to lift the ban, but later determined that they did not need to change legislation to do it (Poitras, 2018). In 2019, Premier Higgs carved out a small exemption to the Liberal moratorium in an area near Sussex where Headwater Exploration, formerly known as Corridor Resources, was already extracting gas (Cox, 2023).

Former Premier Blaine Higgs has been an advocate for expanding the gas industry, including through fracking (O’Connor, 2023). New Brunswick does have a limited number of seasonally operated gas wells (Huras, 2024). At a 2023 conference in the Netherlands, Higgs framed New Brunswick’s hydraulic fracturing potential in a global context:

"Europe is in crisis. The war today is probably fifth or sixth on the news cycle in New Brunswick, and in Canada, and we have such an opportunity as a nation, not to mention as a province, to be a major energy supplier for Europe, and to do it in a timely fashion. When I talk about that, in relation to New Brunswick, it is our natural gas development."

We have huge resources of natural gas, very clean natural gas, we can shut down four coal plants in Atlantic Canada with our natural gas." (O’Connor, 2023).

Aboriginal groups in New Brunswick strongly rejected Higgs assertion that he could green light hydraulic fracturing in some parts of the prov- ince without the need for consultation (CBC News, 2023).

In late 2024, New Brunswick elected a new government under Premier Susan Holt. As of the date of this publication being submitted, the new premier has not announced a policy on natural gas or fracking, nor did any policies in this regard appear in her election platform. However, Holt had previously criticized Higgs’ positions on natural gas. It remains to be seen whether or to what extent the new government will result in a change on natural gas policy.

The New Brunswick saga, of course, reveals the problem Canada has, which is a failure of leadership. The poor people from New Brunswick have been pushed around by one politician after another for almost two decades, with no progress, yet a shale gas bonanza lies beneath their feet. Will things ever change? No one knows, but the Fraser Institute report is at least making an issue out of it, and that's a start.

#FraserInstitute #Canada #NewsBrunswick #Leadership #ShaleGas #Fracking #HydraulicFracturing

Well, since the USA doesn't want it, why?