Best Energy Picks - July 27, 2024

Readers pass along a lot of stuff every week about natural gas, fractivist antics, emissions, renewables, and other news relating to energy.

This week’s best energy picks:

Renewables Are Cheap, Unless You Can’t the Subsidies! — The Paris Climate Agreement Is But A Big Green Grift! — Don't Believe What You Read Abut Climate Impacts on Food Production — Carbon Credit Scams? There's Gambling Going on Here? I'm Shocked! — and much more.

Renewables Are Cheap, Unless You Count the Subsidies!

This article, written to show renewables are cheap, actually shows they are just the opposite:

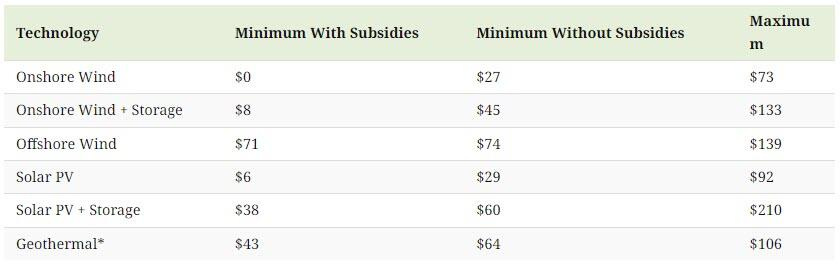

Onshore wind power effectively costs $0 per megawatt-hour (MWh) when subsidies included in the Inflation Reduction Act, such as the Investment Tax Credit, Production Tax Credit, and Energy Community Adder, are applied.

Demand for storage solutions is rising quickly. If storage is included, the minimum cost for onshore wind increases to $8 per MWh. Offshore wind, while more expensive, still presents a competitive option at a minimum of $71 per MWh with subsidies.

Solar photovoltaics (PV) have similarly attractive economics.

With subsidies, the minimum cost is $6 per MWh. When including storage, $38 per MWh. Notably, the maximum cost of solar PV with storage has significantly increased from $102 in 2023 to $210 in 2024, although the cost of solar alone is still 83% cheaper in 2024 than it was in 2009, according to Lazard.

The inflation of 2022–2023 took a toll on solar PV and onshore wind, pushing their maximum unsubsidized costs back up to where they were in 2013 and 2015, respectively. However, solar PV dropped by $4 and onshore wind by $2 from 2023–2024.

For gas-combined cycle plants, which combine natural gas and steam turbines for efficient electricity generation, the maximum price has climbed $7 year-over-year to $108 per MWh…

The cost dynamics of energy production are shifting towards renewables, driven by market forces, technological advancements, and government subsidies, according to Lazard. As renewables become cheaper, they are poised to play a dominant role in the future energy mix, providing both economic and environmental benefits.

Only an ideologue or a grifter could believe the message of the last paragraph, which shows us Lazard has a very definite agenda. Its own data shows us this. Storage and direct subsidies are just the beginning of the costs. The real expense is the loss of efficiency and costs of baseload backup. Therefore, the maximum costs and those beyond are what is relevant, not the minimum.

And, when one compares just Lazard’s maximum costs, a combined cycle gas plant operates at $108 per MWh versus $133 for onshore wind with storage, $139 for offshore wind and $210 for solar with storage. There is no damned free lunch!

Hat Tip: D.S.

Well, Good! The Paris Climate Agreement Is But A Big Green Grift!

Reading this article, one quickly realizes two things. First, that nothing is ever enough for the ideologues and grifters. Secondly, that electricity demand is likely to expand far beyond the capabilities of any amount of land consuming, uneconomical renewables.

The U.S. is making deep cuts in its greenhouse gas emissions as clean energy booms — but not enough to hit the target it set under the Paris Climate Agreement, according to a new analysis from Rhodium, a research company that tracks U.S. progress toward its climate goals.

Under the agreement, in which 194 countries pledged to limit global average rises in temperature to well below 2 degrees Celsius, the U.S. set a goal of reducing its emissions by at least 50% below 2005 levels by 2030. The Rhodium report projects U.S. greenhouse gas emissions will fall 32% to 43% below that threshold by 2030 and 38% to 56% five years later.

The report suggests that clean energy investment is accelerating rapidly, that economic growth no longer depends on fossil fuels and that President Joe Biden’s two climate initiatives — the Inflation Reduction Act and the Infrastructure Investment and Jobs Act — are helping push the pace of electrification.

But there are headwinds, as well: Power-hogging data centers have begun to push electricity demand higher, the Supreme Court recently issued a ruling that undermined federal regulatory power, and Democrats and Republicans are pushing radically different climate agendas as the election looms…

The need for new sources of electricity is urgent. The report authors estimate that electricity demand will be 24% to 29% higher in 2035 than in 2023 as more vehicles and appliances go electric and as energy-intensive data centers are used to run artificial intelligence systems, mine cryptocurrency and power cloud computing. The estimated increase in demand is much higher than Rhodium predicted just last year.

Notice, too, how EVs are increasing demand, which goes against the very principles of "green energy."

Hat Tip: R.N.

Don't Believe What You Read Abut Climate Impacts on Food Production

A good lesson here about using one's own knowledge to check media stories:

We have all seen the stories, the favorites of the media usually have to do with foods that are popular semi-luxury items, depending on where you live, like cocoa beans, coffee, and wine.

For instance, Forbes put out an article claiming that cocoa, olive oil, rice, and soybeans are all “particularly vulnerable” to the effects of “climate-induced stressors.” I will be looking at this article as a case study of sorts for the kind of bad journalism I am talking about…

That Forbes article in particular stuck out to me because I already knew from the second sentence that it was nonsense based on previous work I have done looking into production and yields for all the crops listed. First, the bait and switch: Forbes’ article title, “Climate Change's Toll On Global Agriculture: A Looming Crisis,” and introductory paragraph contain no indication that what is about to be discussed actually is not a global problem, but a regional one, and sometimes the problem does not exist at all.

For cocoa beans, they focus on West Africa, for olive oil the Mediterranean region, for rice they chose Italy and India, and for soybeans the United States and South America. In each of those regions, the overall trend for their crop production is positive.

Globally, every single crop listed by Forbes, according to data from the United Nations Food and Agricultural Organization, has broken all-time records for production and yields year after year. On occasion, there is a less good year, but the trendline remains positive.

Since 1990, when the worst effects of climate change supposedly began to manifest, world production of cocoa beans has increased 132 percent, setting an all-time high in 2022. Olive oil has seen a rise of 124 percent. Overall rice production has risen 49 percent since 1990, and India alone saw a 75 percent increase. Soybeans, in part subsidized by the U.S. government, are certainly not struggling in this country, and worldwide soybean production has risen 221 percent.

There is nothing like the facts to dispense with media narratives spun by journalism graduates who only want to save the world and get credit for it.

Hat Tip: T.Z.

Carbon Credit Scams? There's Gambling Going on Here? I'm Shocked!

Nothing about this is surprising, of course:

A large number of carbon credit projects are claiming to preserve land that is already being protected by Brazilian conservation efforts, The Washington Post reported Wednesday.

Over the past two decades, so-called “carbon cowboys,” people who set up carbon credit initiatives for financial gain, have launched land preservation projects across the Amazon rainforest, generating carbon credits worth hundreds of millions of dollars and building a thinly regulated market valued at nearly $11 billion worldwide, according to The Washington Post. The Brazilian government’s anti-deforestation policies already safeguarded more than 78,000 square miles of land used for preservation projects before they were claimed for carbon credits, and 29 of the 35 internationally certified projects in the Amazon overlap with public lands, meaning a large percentage of carbon credits overlap with already existent conservation measures.

The estimated total value of the offsets sold by these 29 ventures is $212 million, according to an analysis performed by The Washington Post using annual market rates. Multi-billion dollar companies like Netflix, Delta Air Lines, Spotify, PriceWaterhouseCoopers and Boeing are just a few of the major corporations that purchased these credits in order to offset their emissions.

Corporations like these also purchase carbon credits as a way of improving their environmental, social and governance (ESG) performance, according to veteran energy consultant David Blackmon.

“Most carbon credit trading systems amount to wealth transfer schemes designed to benefit the very rich elites and provide near-zero or absolute zero benefit to the environment,” Blackmon told the Daily Caller News Foundation. “For the most part, companies buy these credits for the simple fact that they are forced to do so either by wrong-headed government regulations or by ESG demands from green investors and financial institutions.”

Our friend, David Blackmon, gets it correct once again!

Hat Tip: S.H.

And, Briefly:

Global Greening Now So Clear, Climateers Stop Saving Deserts, from S.H.

Wind on the Island, from M.A.

California Fracking Ban Nears Finalization, from J.S.

Geopolitical Risks Threatening the Uranium Supply Chain, from D.S.

From Bad to Worse: Energy Policy Under A Kamala Harris, from D.B.

Activists Try to Shut Down Uranium Mine, from A.C.

US Hits Record High Electricity Generation From Natural Gas, from D.S.

#Energy #NaturalGas #BestPicks #Climate #GreenEnergy #Money #Power #Electricity #Solar #GlobalWarming #Wind #EVs #Oil #Gas

I've wondered about the carbon credits. If I understand it, the solar and wind plantations are using this gimmick as an extra source of capital, sort of out of thin air. And who are the sellers of Amazon carbon credits? Corporate land owners? Lots of questions...