Best Energy Picks - December 21, 2024

Readers pass along a lot of stuff every week about natural gas, fractivist antics, emissions, renewables, and other news relating to energy.

This week’s best energy picks:

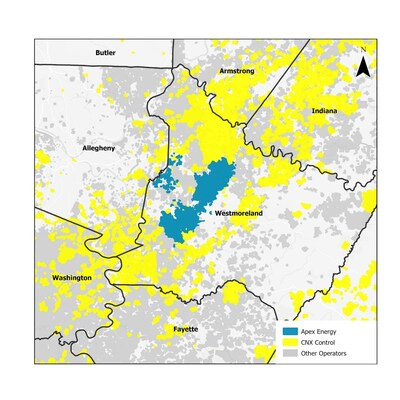

CNX Continues to Show How It’s Done

CNX is a star performer in the oil and gas industry and does all sorts of interesting things, like its Radical Transparency program, for example. Now, it's expanding its portfolio in Western Pennsylvania:

CNX Resources Corporation announced today it has entered into a definitive agreement to acquire the natural gas upstream and associated midstream business of Apex Energy II, LLC ("Apex"), a portfolio company of funds managed by Carnelian Energy Capital Management, L.P. ("Carnelian"), in the Appalachian Basin for total cash consideration of approximately $505 million, subject to certain adjustments including an effective date of October 1, 2024. Completion of the transaction, which is subject to the satisfaction of customary closing conditions, is expected to occur in the first quarter of 2025.

CNX president and CEO Nick Deiuliis stated, "This transaction represents a rare opportunity to acquire a highly complementary asset adjacent to our existing operations. It underscores our confidence in the stacked pay development opportunities that have been unlocked from pioneering the deep Utica in this region."

The acquisition strategically expands CNX's existing stacked Marcellus and Utica undeveloped leasehold in the CPA region and provides an existing infrastructure footprint that can be leveraged for future development. Additionally, CNX expects operational and other development synergies to add incremental value to the core business in the coming years.

Note the discussion regarding Deep Utica, which we know extends across Pennsylvania, and into adjoing states as well. The Marcellus is just the beginning.

Hat Tip: B.A.

The Landman series has gotten a lot of attention but here is a nice snippet about a real landman working for Coterra Energy in the Permian Basin:

I’ve gotten to know various landmen over the years, including a gentleman from Northeast Pennsylvania who helped establish Coterra’s presence in Susquehanna County, which is now the heart of the Marcellus, producing huge amounts of natural gas. I recall him telling me it was going to be big and, boy, was he correct!

Hat Tip. W.D.

The Russian Bear Out to Be Scared with Trump Coming Back!

Dan Markind lays out why Vladimir Putin ought to be sleeping with one eye open as Trump returns:

Following Putin’s invasion of Ukraine in February 2022, Moscow became more dependent on its energy exports for income. International sanctions hit hard at the wealth of Russia’s elite. By the first anniversary of the invasion in February 2023, Bloomberg estimated that the 23 Russian billionaires among the world’s 500 wealthiest people had collectively lost $67 billion, or approximately 20% of their pre-war net worth of $339 billion.

By late 2024, however, these oligarchs had recovered much of their wealth. This was partially due to stabilizing oil prices at around $75 per barrel. While that figure was down from the pre-invasion highs, that price was nevertheless sufficient to balance the market. Russia was also assisted by its ability to continue exporting energy to Europe and other places despite the sanctions. These factors allowed the top Russian billionaires to increase their collective net worth to an estimated $360 billion this year.

However, the cumulative toll of three years of attritional warfare, amplified by the recent geopolitical setbacks, makes it more difficult for Russia to hold the line on outside pressure…

[M]uch of their future might depend on Donald Trump. Russian energy exports already fell by 100,000 barrels per day in November. This resulted in a revenue loss of $1.1 billion. Should Trump tighten the price cap on Russian oil, or crack down on its shadow tanker fleet, and thereby raise the pressure on Europeans to cut off Russian energy exports completely, some believe that this would remove one billion barrels a day of Russian crude oil from the market almost entirely, again balancing the market but constraining global supply.

Thus, the Trump Administration’s early energy decisions may be a key driver of foreign events in 2025, especially for Russia. By tightening the energy screws on Russia, Trump may cause a break between Putin and his oligarchs. With even more pressure now bearing down on the Russian President from another source, this one close to home via its oligarchs, Mr. Putin will have to move very deftly to deflect the difficulties threatening his continued rule.

As usual, Dan puts his finger on what’s really happening in the politics of energy.

Hat Tip: D.M.

Natural Gas Is Critical to Powering the Grid and the Economy

Nuclear energy must be part of our energy future, but natural gas is now;

As North America grapples with the challenge of providing secure, affordable, and sustainable energy amidst soaring electricity demand, it is time to accept this fact: Natural gas remains the most practical solution for powering our grid and economy.

Nuclear power’s limitations are rooted in its costs, risks, and delays. Even under ideal circumstances, building or restarting a nuclear facility is arduous. Consider Microsoft’s much-publicized plan to restart the long-dormant Unit 1 reactor at Three Mile Island in Pennsylvania. This project is lauded as proof of an incipient “nuclear revival,” but despite leveraging existing infrastructure it will cost US$1.6 billion and take four years to bring online.

This is not a unique case. Across North America, nuclear energy projects face monumental lead times. The new generation of small modular reactors (SMRs), often touted as a game-changer, is still largely theoretical. In Canada—Albertain particular—discussions around SMRs have been ongoing for years, with no concrete progress. The most optimistic projections estimate the first SMR in Western Canada might be operational by 2034.

The reality is that nuclear energy cannot scale quickly enough to meet urgent electricity needs. Canada’s power grid is already strained, and electricity demand is set to grow significantly, driven by electric vehicles and enormous data centres for AI applications. Nuclear power, even if expanded aggressively, cannot fill the gap within the necessary time frames.

Natural gas, by contrast, is abundant, flexible, low-risk—and highly affordable. It accounts for 40 percent of U.S. electricity generation and plays a critical role in Canada’s energy mix. Unlike nuclear, natural gas infrastructure can be built rapidly, ensuring that new capacity comes online when it’s needed—not decades later. Gas-fired plants are cost-effective and capable of providing consistent, large-scale power while being capable of rapid starts and shut-downs, making them suitable for meeting both base-load and “peaking” power demands.

More evidence we need it all; coal, gas, and nuclear!

Hat Tip: D.S./R.N.

And, Briefly:

EPA Approves California’s Plan to Ban Gas-Powered Cars by 2035, from J.C.

Oil, Gas Groups Issue 'Urgent Call' to House Speaker, from R.S.

Old King Coal Just Keeps Going and Going and Going, from S.H.

Biden Supplies $15 Billion Loan To PG&E to Combat Climate Change, from R.N.

Biden Erects Another Last-Minute Roadblock To Trump Energy Agenda, from S.H.

Germany’s Gas Use and Power Prices Jump Amid Weak Wind, from R.N.

Permitting Reform: A Strategic Imperative for U.S. National Security, from S.H.

#Energy #NaturalGas #BestPicks #Climate #GreenEnergy #Money #Power #Electricity #Solar #GlobalWarming #Wind #EVs #Oil #Gas #FreeSpeech

Thanks for linking some of my posts, Tom.