Offshore wind is dying, whether the corporatists behind these behometh boondoggles admit it or not. Orsted, one of the giants of the climate corporatists and their industry, just cancelled a big project in the UK, even though its crazed energy minister was fully in support of it.

Here’s the company announcement via the London Stock Exchange (emphasis added):

Today, Ørsted’s Board of Directors approved the interim report for the first quarter of 2025. In Q1 2025, we have focused on the execution of our four strategic priorities, which aim at solidifying Ørsted's leading position in offshore wind towards the end of the decade.

The offshore wind industry is challenged in the short term with headwinds relating to supply chain, regulatory, and macroeconomic developments. We are following the developments in the regulatory landscape closely and continuously assess any potential impacts hereof. The long-term fundamentals for offshore wind are strong due to the increasing global electricity demand, a strengthened focus on energy security and affordability through renewables, and improved framework conditions in several major markets.

Rasmus Errboe, Group President and CEO of Ørsted, says in a comment to the interim report for the first quarter of 2025:

“I’m pleased with our operational performance and earnings in Q1 2025, and we remain fully focused on the execution of our four strategic priorities. During the quarter, we had solid operational earnings supporting our full-year guidance, and we continued to deliver on our farm-down programme by completing offshore and onshore farm-downs. We also continued to deliver on our construction portfolio as we commissioned our offshore wind farm Gode Wind 3 in Germany, reaching more than 10 GW of installed offshore capacity.”

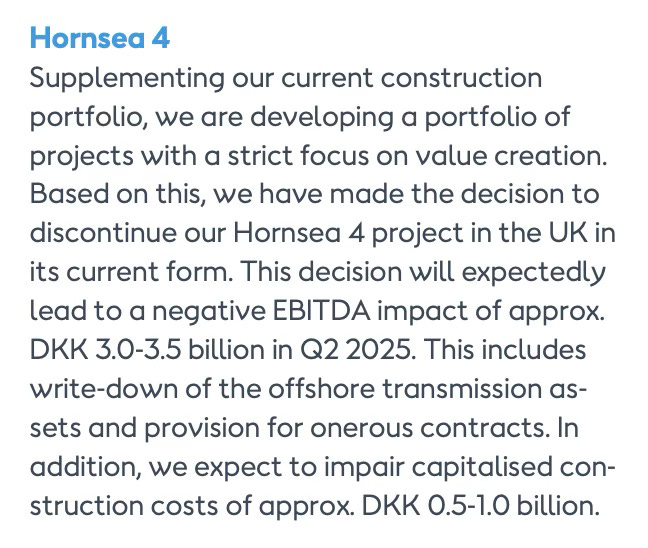

“After careful consideration, we’ve decided to discontinue the development of our Hornsea 4 project in its current form, well ahead of the planned FID later this year. The combination of increased supply chain costs, higher interest rates, and increased execution risk have deteriorated the expected value creation of the project.”

Ignore the PR department crafting of the bollocks: the facts speak for themselves and the use of weasley terms such as “macroeconomic developments ”and“ increased execution risk” speak volumes to anyone with a well-oiled BS detector. The company’s full interim report tells us “government grants” revenue represented 15% of total offshore wind revenue and included this little note:

Income from government grants in Offshore decreased compared to the first three months of 2024 due to generally higher power prices, which resulted in a lower subsidy per MWh produced.

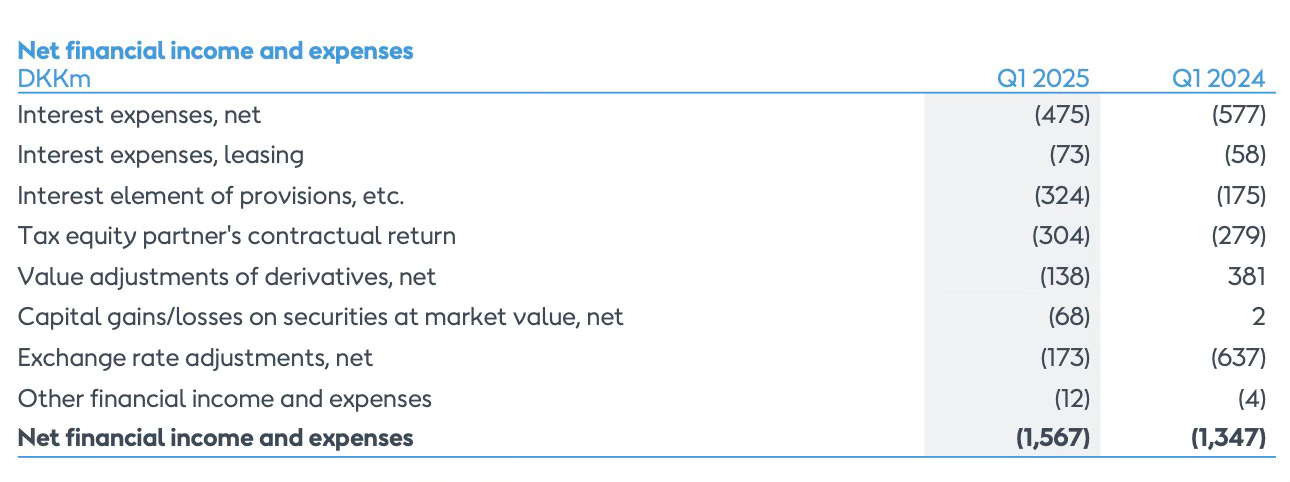

It had been 25% of total offshore revenue for the same quarter in 2024. The loss in total offshore grants was roughly twice the gain in total revenue, which hints at the dependence of offshore wind on subsidies, but there’s more, including this table showing the company as a whole saw increased losses year-to-year.

And, then, there's this:

And, this;

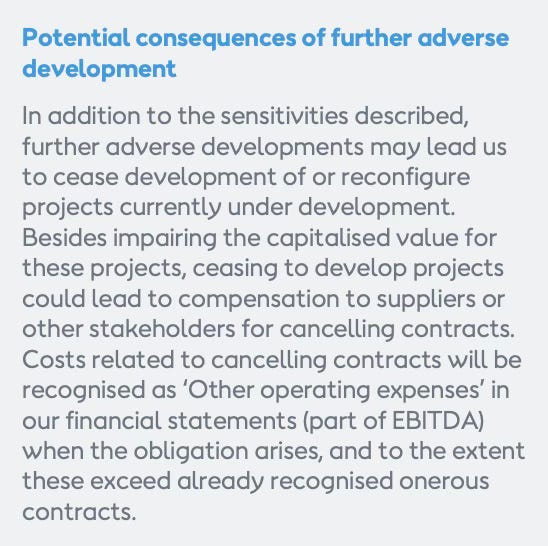

Clearly, Orsted isn’t just looking Hornsea but, rather, all offshore wind projects. Why? Because the entire subsidy scheme is both unaffordable and becoming well-known, especially as electric prices skyrocket.

#Orsted #Offshore #OffshoreWind #Win #Hornsea #Grants #Subsidies

Don Quixote strikes again.