PJM Folks Sure Are Nervous About Energy Transition: They Know the Problem and That We'll All Pay More for Less Security

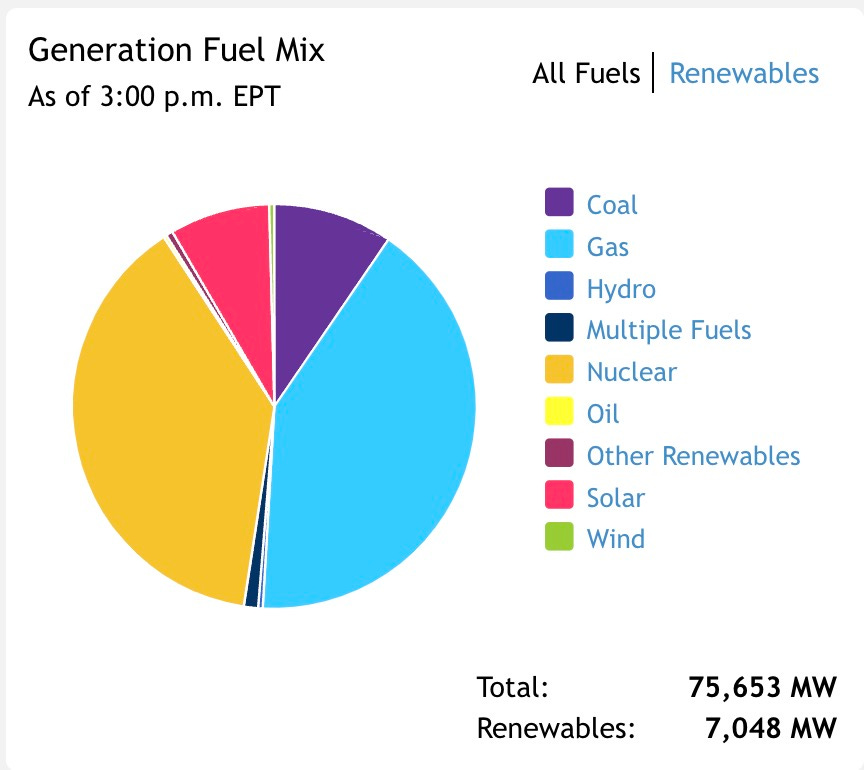

My electricity comes from the PJM grid and every now and then I check the PJM website to see what this regional transmission organization (RTO) is doing at the moment and planning for the future. I always look first at the generation fuel mix chart. Here's what it showed for 3:00 PM on Sunday:

Although most of the website is undecipherable to anyone but insiders, as is all too typical for RTOs, this chart is easily understandable. It shows natural gas supplied 41.4% of the fuel to generate my electricity, nuclear accounted for 38.4% and coal produced 9.5%. That's a total of 89.3% and renewables amount to only 9.3%. Natural gas, nuclear and coal are highly efficient dispatchable sources of fuel to make electricity. They represent energy security for those of us within the PJM region.

There's a bad moon rising though and it is illustrated on another chart found here:

These are projects for which permission to get on the PJM grid is requested and it largely consists of solar, storage, and wind. There is no coal, no nuclear, and very little natural gas. And, that's a problem, because renewables are not dispatchable, and if the storage is via batteries it's useless for anything but the shortest of blackouts.

Our grid, in other words, is about to be turned inside-out and upside-down. But, there is a huge risk to our energy security, and it's revealed in a PJM report issued earlier this year. It's called “Energy Transition in PJM: Flexibility for the Future,” and it's full of quotes indicating the nature of that bad moon rising. Consider these (emphasis added):

PJM continues to track concerns raised in the previous phase of this study – that as demand growth and thermal resource retirements accelerate and the pace of development and deployment of new resources continue to lag and may result in a shortfall in supply by 2030. The findings of this study add focus to system complexity anticipated beyond 2030, as unprecedented demand growth continues with the majority of the PJM interconnection queue made up of solar, wind, storage and hybrid resources.

In the Policy scenario, 41 GW of retiring generators (coal, natural gas and oil) are replaced by 84 GW (nameplate capacity) of new entry by wind, solar, storage and hybrids resources…

[L]ess than doubling the amount of resource retirements results in a quadrupling of the amount of new entry needed to maintain the same level of resource adequacy. Despite 275 GW of renewables and storage being built in the Accelerated scenario, 79 GW of flexible thermal resources are still needed to maintain resource adequacy at one-in-10 LOLE. This highlights that substituting thermal resources with renewable generation may get significantly more challenging as the energy transition progresses.

The demand in each scenario reflects growth from end-use electrification, electric vehicles and data centers. Recent history of this anticipated growth has proven unprecedented and dynamic. Average growth estimates for PJM’s summer peak, for example, have increased by 375% between the 2022 and 2024 load forecasts – from 0.4% per year to 1.6% per year. This trend adds to the complexity of ensuring reliability through the energy transition.

Increasing amounts of intermittent wind, solar and storage resources will change today’s interactions between neighboring systems and raise new questions about the ability to lean on each other during times of system stress…

As the resource mix changes more substantially in the Accelerated scenario, interface limits are reached more often. As PJM and its neighbors look ahead to existing policies coming to fruition, focus must be placed not just on total transfer capability available, but on how well that existing capability is being managed and coordinated…

The study shows an increase in total interchange between PJM and its neighbors of 35% between the Base and Accelerated scenarios. In addition, the Accelerated scenario shows periods where PJM goes from exporting to importing 10 GW or more in small time frames. This variability is driven by increases in intermittent generation, particularly wind. In general, the varying renewable output between PJM and its neighbors is complementary…

Increasing levels of intermittent resources create significant variability and uncertainty to be managed by flexible resources…

From the Base to Policy scenario, natural gas resource capacity factors increase to manage thermal retirements. Moving into the Accelerated scenario, natural gas utilization decreases as the combined cycles operate as flexible peakers rather than baseload…

Periods of low thermal fleet utilization are coupled with extended periods of time when demand is met by zero- or low-cost resources. Natural gas energy revenues decreased 54% across the year between the Base and Accelerated cases, ranging from a 39% decline in the winter to a 91% drop in the spring. Additionally, large amounts of storage are assumed to be built to meet system ramping needs.

If the gas fleet of today remains as is, or decreases due to regulatory pressures, but additional storage resources do not get built at pace, immense pressure will be placed on natural gas to supply the ramping needs for the system. Changes to market mechanisms should be evaluated to ensure that adequate resources are incentivized to help PJM manage increasing system uncertainty and volatility.

This analysis may be summed up as follows: PJM is facing tremendous growth in demand, will be forced to absorb intermittent solar and wind to meet those demands and isn't sure at all there will be enough baseload generation to back them up. The market has been distorted beyond all imagination and baseload generation that ensures energy security today is being squeezed from every direction by overregulation and rules favoring renewables.

The one safety valve is natural gas, but with heavily subsidized solar and wind in the mix, natural gas plants are also likely to suffer a major loss of revenue, making them far less efficient and raising electricity prices for all of us. Meanwhile, energy security is being carelessly thrown to the wind. That's exactly what's happened in California, Germany, and so many other places, so we know the outcome. No wonder PJM is nervous.

#PJM #ElectricGrid #Electricity #EnergySecurity #Solar #Wind #EnergyCosts #Reliability #Dispatchability

Good example of trouble ahead. Very important point: "if the storage is via batteries it's useless for anything but the shortest of blackouts." Most grid backup battery systems talk about providing 4 hours of backup. Why bother? We can all get along with no power for 4 hrs. The real danger, to people and to businesses and to the economy, is week-long blackouts - and it could happen.

And we'll be told, "THE SOLUTION IS MORE RENEWABLES AND STORAGE"!